News

New Study Shows AWS Losing Ground to Azure in Enterprises

It's the latest in a series of surveys that show Microsoft's public cloud gaining developer and admin mindshare.

Although Amazon Web Services Inc. (AWS) still maintains its lead in the public cloud space, Microsoft's Azure platform may be turning the tide in larger enterprises. A new survey lends credence to that perception.

The survey comes vio Sumo Logic, examining "The New Normal: Cloud, DevOps, and SaaS Analytics Tools Reign in The Modern App Era."

Sumo Logic, which describes itself as a "machine data analytics service," contracted UBM to survey 235 IT operations, application development, and information security professionals at companies with at least 500 employees, with about half of the respondents working at companies with 5,000 or more employees.

At that high end of the enterprise spectrum, the survey found, Azure actually beats AWS.

"In the early days of the cloud, Amazon Web Services (AWS) took the lead as the cloud computing vendor of choice," the survey report said. "But the survey revealed that as the cloud matures, organizations are becoming more comfortable with vendors other than AWS and are using multiple cloud vendors. In fact, while other reports show that AWS still has a lead in cloud market share, the top cloud vendor in this survey -- which included only organizations with at least 500 employees -- was Microsoft Azure.

[Click on image for larger view.]

IaaS and PaaS Vendors (source: Sumo Logic)

[Click on image for larger view.]

IaaS and PaaS Vendors (source: Sumo Logic)

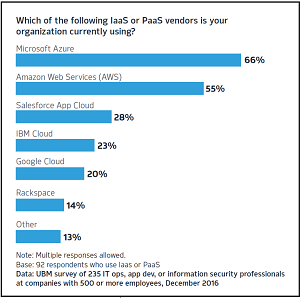

"When asked which IaaS or PaaS vendors they were using (with multiple responses allowed), 66 percent of respondents cited Azure. Interestingly, more than half of the Azure users were from organizations with more than 10,000 employees, which suggests that Microsoft's cloud is particularly popular with large enterprises. AWS came in second with 55 percent of respondents, followed by Salesforce App Cloud (28 percent), IBM Cloud (23 percent), and Google Cloud (20 percent)."

This finding reinforces some conclusions from other surveys. For example, last month's survey from Spiceworks Inc. found that Azure beat AWS in the Infrastructure-as-a-Service (IaaS) space. That report said: "In the public cloud IaaS provider category, Microsoft Azure is the most commonly used (16 percent), followed closely by Amazon Web Services (AWS) at 13 percent. Azure is also expected to see the most growth in the next 12 months with 21 percent of IT pros considering it -- while AWS is being considered by 11 percent."

A January report from financial analyst FBR Capital Markets said: "We continue to believe 2016 will be a '206 area code street battle for the cloud,' with Microsoft firmly best positioned as the vendor to compete with AWS on the enterprise cloud front for years to come."

Going further back, a RightScale Inc. report from 2015 said: "Cloud competition for enterprises (1000+ employees) got a lot more interesting in 2015. AWS still maintains a lead (50 percent vs. 49 percent in 2014), but Azure IaaS has closed the gap significantly (19 percent vs. 11 percent in 2014). As a result, the AWS lead in the enterprise narrowed from more than 4x to 2.5x its nearest competitor."

Taken together, these and other reports indicate that if AWS has any vulnerabilities that threaten its longstanding cloud computing leadership, they come at the high end and in IaaS offerings.

However, as mentioned, there are always contrasting reports to point to. For example, brand-new research from VisionMobile Ltd. almost directly disputes the Sumo Logic report.

The VisionMobile survey report said: "Amazon Web Services (AWS) is the most popular primary cloud hosting at every company size. For the smallest companies (1-5 employees) where Amazon has just a 15 percent share, they face very credible competition from Microsoft (12 percent), Google (11 percent), and Digital Ocean (10 percent). However, when we look at larger companies, Amazon's share grows to 26-27 percent at every size, Microsoft stays in the 11-13 percent range, while Google fades along with Digital Ocean."

Among developers, though, that VisionMobile report somewhat echoes the big-company advantage of Azure, stating: "Microsoft shows greater strength equally with developers who target large enterprises, and those who target small to medium businesses (14 percent each)," it continued. "They are weaker with those targeting consumers (11 percent) or professionals (9 percent)."

Moving beyond the issue of market share, other key findings of the Sumo Logic report highlighted by the company include:

- 80 percent of those surveyed are using or planning to use public cloud services.

- 68 percent either plan to adopt DevOps practices or are already doing so.

- 42 percent are deploying and updating apps more frequently than in the past.

- 55 percent said public cloud services are more secure than they used to be, but they

still have room for improvement.

- Most organizations are using between four and 10 tools to manage their growing portfolios of custom apps.

About the Author

David Ramel is an editor and writer for Converge360.