News

Analysts: SDN Growth To Hurt Cisco

A market in transition means "particularly dire" consequences for the networking giant.

Financial analysts from Credit Suisse today said the enterprise switching market is changing and the expected growth of software-defined networking (SDN) will hit Cisco Systems Inc. especially hard.

In a Barron's Soapbox article, Kulbinder Garcha, Vlad Rom, Ray Bao and Ji Park predicted "A Smaller Pie for Networking Vendors" (subscription may be required) in general and lower profits from Cisco in particular. The continuing emergence of nascent SDN technologies has a lot to do with that.

SDN is a network architecture that decouples the control plane from the data plane, moving network "smarts" from devices to software controllers that allow more networking programmability. Cisco and other traditional networking vendors have emphasized putting intelligence about routing and other functionality in the switches themselves. SDN implies intelligent controllers managing dumb or white-box commodity switches. While it has made little inroads so far into the enterprise datacenter, it has received an incredible amount of attention and seems to be an inevitable mainstream technology.

"While SDN is implemented primarily at hyperscale level at the present, we continue to believe that enterprise budget pressures, increase in datacenter traffic, and rise in commodity-silicon performance will eventually drive adoption at enterprise scale," the analysts wrote.

[Click on image for larger view.]

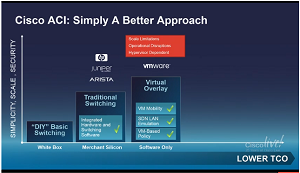

Cisco Champions a "Better Approach" to SDN

[Click on image for larger view.]

Cisco Champions a "Better Approach" to SDN

(source: Cisco Systems Inc.)

Other factors in the industry transition include virtualization, price convergence and the Big Data movement, which will first drive throughput from 1GbE to 10GbE and then to 40GbE and 100GbE.

"In short, the emergence of SDN and increasing competition from 1GbE to 10GbE demand shifts will likely pressure incumbents' margins and as a result expect the impact to Cisco [to be] particularly dire."

Cisco isn't alone, however, as the Credit Suisse analysts predicted changing demands in the market will shrink industry gross profit regardless of the eventual technology leader.

The analysts singled out Cisco as the leader in the switching industry, with about 70 percent market share that provides 30 percent of the company's total revenue. As the top dog right now, the company might have the most to lose.

"While visible product success and traction of Nexus 9000 switches could provide near-term support for Cisco Systems' ... margins, we see shrinking gross profit dollars for the entire industry negatively impacting margins."

The analysts aren't alone in their opinions. Last month, a BusinessWeek.com article noted: "AT&T Inc., Goldman Sachs Group Inc., Facebook Inc. and other companies are embracing software to run their networks -- a shift that poses a challenge to hardware makers led by Cisco Systems Inc."

Cisco isn't standing still, however. The new Nexus 9000 switches are the foundation of its Application Centric Infrastructure (ACI), which the company positions as a new-age networking technology that incorporates some SDN philosophies and actually improves upon SDN. Cisco has explained its position in a white paper titled "Software-Defined Networking: Why We Like It

and How We Are Building on It."

And, perhaps to combat a perception as a proprietary holdout in a new age of open standards networking, the company is also active in several SDN industry initiatives with the word "open" in their titles, such as the Open Networking Foundation and OpenDaylight project -- not to mention its own Open Network Environment.

Cisco also reported better-than-expected quarterly financial results last month and has been buying its way into the SDN arena -- like many other major vendors -- by acquiring SDN-oriented companies such as Insieme Networks and Tail-f, the latter of which happened just a few weeks ago.

Furthermore, judging from aggressive commentary from Cisco CEO John Chambers and others ("John Chambers: Cisco Is Going To Crush VMware"), the company is aware of the coming challenges and is taking steps to stay on top. Or, as Forbes put it: "Cisco Hopes To Combat SDN Threat and Defend Margins with New, Simplified Marketing Strategy."

So whether it be through technology or marketing, expect the networking giant to put up quite a fight.

About the Author

David Ramel is an editor and writer at Converge 360.