News

Research Firm Says SDN Lags in Datacenters

Software-defined networking (SDN), a relatively new, disruptive technology, isn't making datacenter inroads as quickly as expected, according to new research from IHS Inc.

SDN, according to Wikipedia, lets network administrators programmatically and dynamically initialize, control, change and manage network behavior through open interfaces. While promising great changes in the way networks are built and managed, it's a young technology still evolving. For example, it was only in 2011 that the Open Networking Foundation was formed, charged with furthering the technology.

That mission isn't succeeding as rapidly as some industry experts thought, as developments in the young SDN movement so far mainly have been characterized by test projects and proofs of concept, primarily led by major telecommunications carriers and service providers. After that tech segment was converted, conventional thinking went, the enterprise datacenter would be next.

But that plan isn't progressing on schedule, according to the new "Data Center SDN Strategies Global Service Provider Survey" (available to IHS subscribers only) from IHS Markit. In fact, even service provider datacenters have been slow to convert.

"Getting to live production is taking more time than expected," IHS said in a research note about the new survey yesterday. "This means that the most innovation-driven part of the market critical for new revenue -- SDN controllers, datacenter orchestration and SDN applications -- is still wide open. Although the leaders in the SDN service provider datacenter market are becoming clearer, especially for physical network equipment, we do not expect the market to solidify until live deployments ramp."

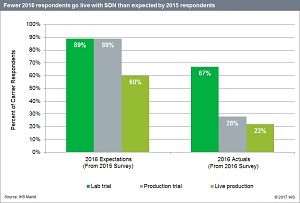

[Click on image for larger view.] SDN Expectations vs. Actuals (source: IHS Markit).

[Click on image for larger view.] SDN Expectations vs. Actuals (source: IHS Markit).

IHS also much earlier cautioned that SDN growth would be slow, in research published in August 2015. "Carriers are starting small with their SDN deployments and focusing on only parts of their network to ensure they can get the technology to work as intended," IHS exec Michael Howard said at the time. "We see in the results of our SDN survey that though momentum is strong, it will be many years before we see bigger parts or a whole network that is controlled by SDN."

That 2015 prediction was borne out by the new research note.

"In the datacenter, lab trials for software-defined networking (SDN) are still dominant over production trials and live deployments," the company said yesteday.

The note continued: "Two-thirds of the service providers participating in our 2016 survey are still conducting lab trials of datacenter SDN, down only slightly from three-quarters in 2015. The number of respondents in production trials and live deployment in 2016 continued to be lower than expected by those taking part in the prior year's study.

The research note also pointed to a slowdown in the installation of bare-metal switches (bare-metal or commodity hardware, as opposed to proprietary hardware, is a key tenet of SDN).

"Bare-metal switch ports comprise, on average, 33 percent of respondents' datacenter Ethernet switch ports (the same as our 2015 study)," the note said. "And, on average, 24 percent of bare metal switch ports are in-use for SDN, up from 12 percent in the 2015 survey. The majority of bare-metal switches are still being deployed at large cloud service providers (CSPs) because skilled programmers who are adept at dealing with bare-metal switching are required to ensure success."

In another finding from the new survey, Cisco Systems Inc. and Juniper Networks Inc. were identified as the top vendors in the SDN space.

"The leaders in the service provider data center SDN market are solidifying for physical network equipment," the IHS research note said. "In an open-ended question, we asked respondents whom they consider to be the top three data center SDN hardware/software product vendors. Cisco, the big player in enterprise networking, was identified as a top-three vendor by 72 percent of respondents, while Juniper was named by 39 percent of respondents.

"Cisco continues to get traction with its SDN solutions, including with educational institutions providing online learning for students, CSPs deploying self-service portals and enterprises adopting hybrid cloud architectures. Juniper, meanwhile, is gaining footing with its contrail cloud and contrail networking solutions."

IHS said the subscriber-only, 30-page survey report asked respondents about the drivers of SDN deployments, barriers and timing; expected capex and opex changes involved with SDN; use cases; security technologies; applications; top-rated vendors; and more.

About the Author

David Ramel is an editor and writer at Converge 360.