News

What Are Gartner's 'Cautions' About Big 3 Cloud Providers?

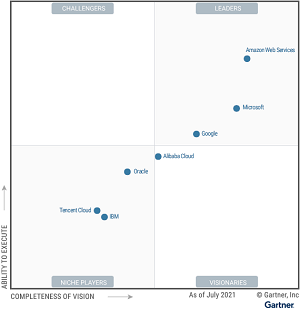

Gartner's 2021 Magic Quadrant report on cloud computing platforms is much the same as it was for 2020, 2019 and 2018: AWS, Microsoft and Google are the three "Leaders" and everyone else is mostly relegated to the "Niche Players" quadrant based on "ability to execute" and "completeness of vision" axes.

What's more, the space is consolidating, with the four top vendors of cloud infrastructure and platform services (CIPS) cornering more than 90 percent of the worldwide market. In the 2021 report, that fourth vendor, Alibaba Cloud, moved from the "Niche Players" quadrant to the "Visionaries" quadrant. The research firm says "Visionaries have an ambitious vision of the future and are making significant investments in the development of unique technologies," while "The Niche Players in the market for CIPS may be excellent providers for particular use cases or in regions in which they operate, but they should ultimately be viewed as specialist providers."

Here's how the quadrants looked going back to 2017 (with older ones measuring Infrastructure-as-a-Service (IaaS) instead of CIPS):

[Click on image for larger view.] Gartner 2021 Magic Quadrant for Cloud Infrastructure and Platform Services (source: Gartner).

[Click on image for larger view.] Gartner 2021 Magic Quadrant for Cloud Infrastructure and Platform Services (source: Gartner).

[Click on image for larger view.] Gartner 2020 Magic Quadrant for Cloud Infrastructure and Platform Services (source: Gartner).

[Click on image for larger view.] Gartner 2020 Magic Quadrant for Cloud Infrastructure and Platform Services (source: Gartner).

[Click on image for larger view.]

Gartner 2019 IaaS Magic Quadrant (source: Gartner)

[Click on image for larger view.]

Gartner 2019 IaaS Magic Quadrant (source: Gartner)

[Click on image for larger view.]

Gartner 2018 IaaS Magic Quadrant (source: Gartner)

[Click on image for larger view.]

Gartner 2018 IaaS Magic Quadrant (source: Gartner)

[Click on image for larger view.]

Gartner 2017 IaaS Magic Quadrant (source: Gartner)

[Click on image for larger view.]

Gartner 2017 IaaS Magic Quadrant (source: Gartner)

With so little change over the years recently, this year we'll just highlight the "Cautions" that Gartner attaches to each of the big 3, because they provide warning signs for enterprises to consider when choosing a vendor. They look like this:

AWS

Challenging renewals: Dozens of Gartner clients across multiple geographies have reported unexpected pressure from AWS sales, which has sharply accelerated over the past year, to increase annual spend commitments by 20 percent to renew existing contracts. Since these customers typically have significant dependence on the platform, they may feel as if they have limited recourse; however, the pressure to increase spend is not AWS's policy and will be eliminated if the customer escalates.

Offering complexity: Discerning between the multitude of solutions, such as those related to containers, databases and data management, requires substantial technical skills in order to appreciate the differences between the offerings and make the appropriate choice. Many enterprises require third-party assistance as a result of the complexity.

Bare-bones offerings: AWS's new services are often not ready for meaningful enterprise consumption for prolonged periods of time because these bare-bones offerings are matured in public. Further, the company's leadership position in IaaS and dbPaaS creates a misleading halo effect for other offerings, such as AWS Outposts, which has experienced modest traction to date.

Microsoft Azure

Resiliency: Microsoft has made concerted efforts to improve resiliency with critical services such as Azure Active Directory, but many Gartner clients remain concerned about the real-world impacts when such critical services are unavailable. Further, Microsoft continues to react slowly to the rollout of AZs with the likelihood that some regions will never be equipped with such resiliency capabilities. Services such as the Azure Kubernetes Service (AKS) continue to experience some outages, particularly in association with updates and maintenance events.

Commercial complexity: Microsoft has very complex licensing and contracting, and a complex account management structure with uneven cloud skills in the field. Further, Microsoft sales pressures to grow overall account revenue prevent it from effectively deploying Azure to bring down a customer's total Microsoft costs.

Novel innovations: Azure's novel innovations in the market for IaaS and PaaS relative to its competitors over the past year were substantially less appealing. Additionally, despite Microsoft Azure's beginnings as an application PaaS provider, Azure's product execution and adoption in this segment have been rather mixed.

Google Cloud Platform

Postsales satisfaction: Some Gartner clients have a poor experience dealing with GCP after committing to use the platform. Much of this stems from the rapid growth of GCP and the organizational immaturity that results.

Limited incentives: Google is currently attracting clients with aggressive pricing relative to its competition, but the discounting is likely to eventually taper off as the company continues to mature with respect to revenue and customers.

Financial losses: GCP is the only CIPS provider with significant market share that currently operates at a financial loss. Further, GCP's success erodes Google's overall healthy gross margins, and the cloud division is a minor part of the parent company's overall revenue.

And Then There's Alibaba

As far as up-and-comer Alibaba Cloud, Gartner says its ascension speaks to a broader, growing movement.

"AWS and Microsoft continue to dominate in much of North America and Europe, where overall cloud growth rates remain strong," Gartner said. "Alibaba is a dominant force in China and a formidable competitor in countries where China has influence.

"However, the era of the Chinese service provider is just beginning. Providers such as Alibaba Cloud, Tencent, Huawei and Kingsoft are showing keen interest in competing, not just regionally within Asia but also in far-from-home regions such as Latin America, where the Chinese providers face a less hostile reception than in the Western world."

With that in mind, the cautions for Alibaba Cloud include:

- Worldwide traction: Alibaba Cloud's market share, though third worldwide, is mostly concentrated in China, and most of its customers are either headquartered in China or global businesses that need a local Chinese presence. The company has yet to have breakout success in markets outside of its home region and is unlikely to meaningfully penetrate such markets.

- Regional competition: Alibaba is facing significant competitive pressure from both established worldwide providers, such as Amazon Web Services (AWS) and Microsoft, and China-focused cloud providers, such as Tencent Cloud and Huawei, which are all vying for a share of a growing market. Further, Alibaba Cloud is caught between geopolitical tension that may be a concern for international clients considering Alibaba Cloud's offerings.

- Transparency: Alibaba Cloud is not as transparent nor predictable with respect to discounting relative to international competitors. Alibaba also still lacks an element of transparency from the perspective of technical details of service implementations.

In its market overview, Gartner spoke about that aforementioned tightening of the global market. "The worldwide consolidation is occurring largely as a result of enterprises seeking industrialized offerings that bring with them a level of dependability and a wide breadth of functionality to satisfy all enterprise workloads," Gartner said. "This is the key difference between a worldwide provider and a boutique regional provider that may have a virtualized offering consisting of compute, network and storage using off-the-shelf virtualization products. The boutique provider is simply unable to compete with the innovation speed of the worldwide providers."

About the Author

David Ramel is an editor and writer at Converge 360.