News

AI Shapes State of the Cloud, 13th Flexera Report Says

Many organizations are investing in generative AI and sustainability initiatives while also trying to balance these with effective cost management, says Flexera in its latest "State of the Cloud" report.

For this 13th edition, some 753 cloud decision-makers and users worldwide were polled by the the SaaS-based IT management solutions specialist to glean insights about the public, private and multi-cloud market.

While past reports detailed how Microsoft Azure was increasingly challenging AWS in usage statistics concerning workloads and so on, this year's report -- based on a late 2023 survey -- turns the spotlight to AI. In fact, on the report's site, the company's very first tease right beneath the title is "AI experimentation outpaces usage."

Indeed, as shown in the chart below, the number of respondents reporting generative AI experimentation (38 percent) does outpace those using it extensively (25 percent), though another 22 percent reported using GenAI sparingly, so nearly half (47 percent) of respondents are using GenAI cloud services in some form.

[Click on image for larger view.] Use of Generative AI (GenAI) Public Cloud Services (source: Flexera).

[Click on image for larger view.] Use of Generative AI (GenAI) Public Cloud Services (source: Flexera).

"In the face of ongoing economic uncertainties, many organizations are investing in transformative initiatives such as generative AI (GenAI) and sustainability," the report said. "At the same time, managing costs effectively remains a top priority -- and trying to find a balance between the two is a formidable challenge. Despite this, cloud usage is on the rise, while wasted spend is decreasing. Hybrid cloud strategies are evolving, with a notable increase in the number of businesses adopting a more comprehensive view of cost management for hybrid deployments, including the licensing of software used in the cloud."

An accompanying news release noted that managing cloud spending is the top challenge faced by respondents, while AI, FinOps, security and sustainability are demanding attention.

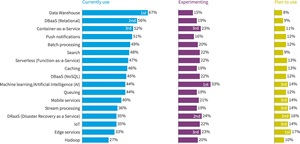

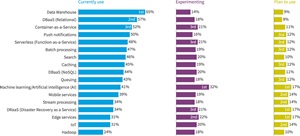

"There are big plans for AI: Nearly all platform-as-a-service (PaaS) offerings saw a gain in usage, with the most prominent being in the data warehouse (up to 65 percent from 56 percent YoY)," Flexera said. "Container-as-a-service (52 percent) and serverless (function-as-a-service) (48 percent) are both up nine percentage points this year. Machine learning/artificial intelligence (ML/AI) had a modest gain at 41 percent, up from 36 percent last year. However, ML/AI is the PaaS offering getting the most attention from companies experimenting (32 percent) or planning to use it (17 percent)."

[Click on image for larger view.] Public Cloud Services Used by Enterprises (source: Flexera).

[Click on image for larger view.] Public Cloud Services Used by Enterprises (source: Flexera).

[Click on image for larger view.] Public Cloud Services Used by All Organizations (source: Flexera).

[Click on image for larger view.] Public Cloud Services Used by All Organizations (source: Flexera).

While the charts above depict how 77 percent of enterprises are either currently using (44 percent) or experimenting with (33 percent) AI/ML, and organizations are experimenting more with AI/ML than with any other PaaS offering, Flexera offered its own POV commentary: "Although current AI/ML usage is only at 41 percent with all respondents, Flexera expects this to increase significantly in the coming years as more and more organizations leverage the emerging GenAI services offered by public cloud providers."

Other highlights of the report as presented by the company show how the AWS/Azure race is heating up, along with more data-driven insights:

- Managing cloud spending remains the top challenge over security: This year marks the second year in which managing cloud spending is the top challenge facing organizations. As in previous years, there needs to be more resources/expertise. More than a quarter of respondents spend over $12 million a year on cloud (29 percent), and nearly quarter (22 percent) spend that much on SaaS.

- Organizations are embracing multi-cloud: Respondents saw a slight increase in multi-cloud usage, up from 87 percent last year to 89 percent this year.

- Enterprises turn to multi-cloud FinOps and security tools: Sixty-one percent of large enterprises use multi-cloud security, and 57 percent use multi-cloud FinOps (cost optimization) tools.

- Siloed apps and disaster recovery (DR)/failover are the top multi-cloud implementations: The top two multi-cloud implementations are: apps siloed on different clouds, DR/failover between clouds. Apps siloed on different clouds increased the most (up to 57 percent from 44 percent YoY). Data integration between clouds increased to 45 percent from 37 percent YoY as organizations looked for the best fit for applications and data analysis.

- AWS and Azure still lead overall: Adoption grew for Amazon Web Services (AWS), Microsoft Azure and Google Cloud. Forty-nine percent of respondents reported using AWS for significant workloads, while 45 percent reported using Azure and 21 percent reported using Google Cloud Platform. In contrast, Oracle Cloud Infrastructure, IBM and Alibaba Cloud usage is substantially lower and relatively unchanged compared to the previous year.

- Cloud faces headwinds with small and medium-sized businesses: SMBs are the highest cloud adopters, but fell off slightly from the previous year, with 61 percent (a drop from 67 percent last year) of workloads and 60 percent of data in the public cloud for both years.

- Sustainability trails cost optimization: Forty-eight percent of respondents say they already have defined sustainability initiatives that include tracking the carbon footprint of cloud usage. When asked how sustainability compares to cost optimization, 59 percent prioritized cost optimization, though an additional 29 percent say that both cloud cost optimization and sustainability are equally prioritized.

About the Author

David Ramel is an editor and writer at Converge 360.