News

In Cloud Giant AI Race, AWS Surges

After Microsoft seized on its OpenAI partnership to establish a solid leadership position in the cloud AI space, and Google quickly declared a "code red" emergency to catch up with first Bard and then Gemini, Amazon wasn't making as much news in AI. That has changed.

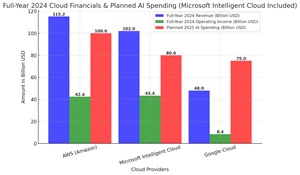

With all three leading cloud providers recently reporting their Q4 and full-year 2024 financial results, they have also revealed plans on further spending on AI, what the financial types refer to as CapEx or capital expenditure. Several announcements, financial reports and earnings calls all point to one thing: Amazon is now making more money and planning more AI spending. Data collected from various sources results in this full-year chart:

[Click on image for larger view.] 2024 Financial Results and Planned AI Spending (source: Financial Reports and Announcements).

[Click on image for larger view.] 2024 Financial Results and Planned AI Spending (source: Financial Reports and Announcements).

An Amazon news release listed many AI-related initiatives among the financial numbers:

- General Availability of Trainium2: EC2 Trn2 instances, powered by Trainium2 AI chips, offer 30-40% better price-performance than current generations of GPU-based instances.

- Project Rainier: A collaboration with Anthropic using hundreds of thousands of Trainium2 chips to build the world's largest AI compute cluster.

- New Amazon SageMaker AI features, including the ability to manage costs and prioritize which workloads should receive capacity when budgets are reached.

- The next generation of Amazon SageMaker, which brings together all of the data, analytics services and AI services into one interface to do analytics and AI more easily at scale.

Furthermore, Amazon CEO Andy Jassy said this in an earnings call transcript provided by The Motley Fool: "On the capex side, as Brian mentioned earlier, we spent $26.3 billion in capex in Q4. And I think that is reasonably representative of what you could expect in annualized capex rate in 2025. The vast majority of that capex spend is on AI for AWS."

Sundar Pichai, CEO of Alphabet and Google, in an earnings call emphasized the company's significant advancements in AI and its positive impact on financial performance. He highlighted Alphabet's comprehensive AI strategy, which encompasses leading infrastructure, world-class research, and widespread product integration.

He said: "We delivered another strong quarter in Q4, driven by our leadership in AI and our unique full-stack approach. We're making dramatic progress across compute, model capabilities and in driving efficiencies. We're rapidly shipping product improvements, and seeing terrific momentum with consumer and developer usage. And we're pushing the next frontiers, from AI agents, reasoning and deep research, to state-of-the-art video, quantum computing and more."

Satya Nadella, chairman and CEO of Microsoft, in a news release about the company's financial results, also emphasized AI: "Our strong performance this fiscal year speaks both to our innovation and to the trust customers continue to place in Microsoft. As a platform company, we are focused on meeting the mission-critical needs of our customers across our at-scale platforms today, while also ensuring we lead the AI era."

He further discussed AI in Microsoft's own earnings call, getting right to the point early on: "Before I dive in, I want to offer some broader perspective on the AI platform shift. Similar to the cloud, this transition involves both knowledge and capital intensive investments. As we go through this shift, we are focused on two fundamental things: First, driving innovation across a product portfolio that spans infrastructure and applications so as to ensure we are maximizing our opportunity, while in parallel continuing to scale our cloud business and prioritizing fundamentals, starting with security."

Even with Amazon's solid financial results and aggressive AI spending plans, Jassy alluded that the company could have done better with requisite resources like AI-friendly processors. The company has an agreement with Nvidia for such chips and is manufacturing its own.

"However, it is true that we could be growing faster, if not for some of the constraints on capacity," Jassy said. "And they come in the form of, I would say, chips from our third-party partners, come a little bit slower than before with a lot of midstream changes that take a little bit of time to get the hardware actually yielding the percentage healthy and high-quality servers we expect."

About the Author

David Ramel is an editor and writer at Converge 360.