News

Report: Netcracker Leads in NFV Management and Orchestration

Current Analysis published new research on network functions virtualization (NFV) -- "the most important transformation that the network industry has undertaken in its history" -- that names Netcracker Technology as the "leader" in NFV Management and Orchestration (MANO).

NFV is an evolving network architecture approach that moves network node functions -- such as load balancing, firewalling and intrusion detection -- from proprietary hardware devices into virtualized software components that can be combined to provide communications services by operators and vendors. It's often associated with another growing technology, software-defined networking (SDN).

The market intelligence firm rated nine NFV vendors according to 15 criteria in its ranking, which is divided into "vulnerable," "competitive," "strong," "very strong" or "leader" classifications.

Netcracker -- now an NEC Corp. subsidiary -- is the lone vendor to attain the latter rating in the "NFV MANO: Competitive Dynamics and Solution Assessments" report, which it made available for download (upon providing registration information).

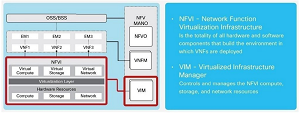

[Click on image for larger view.] ETSI NFV Reference Architecture (source: Current Analysis).

[Click on image for larger view.] ETSI NFV Reference Architecture (source: Current Analysis).

"Netcracker has emerged as the overall leader in this first formal comparison of vendor MANO offerings," the report stated. "While the complexity of the company's telco IT portfolio and latest SDN/NFV operationalization offering, the Agile Virtualization Platform (AVP) is very high, there can be little doubt as to its comprehensiveness in providing a platform capable of supporting almost every aspect of the carrier journey."

Overall, Current Analysis noted the evolving maturation of the nascent technology approach in an acronym-strewn summary:

Our analysis indicates that NFV MANO solutions have progressed considerably over the past 12 months -- many operators are transitioning, with the help of vendors, from proofs of concept (PoCs) to trials, and many are now addressing the practicalities of launching commercial services.

Some indeed have progressed further and launched commercial services, such as virtualized voice-over-LTE (vVoLTE) albeit mostly at VIM [virtualized infrastructure manager] levels of orchestration but increasingly at the VNFM [ virtual network function manager] and even NFVO [ NFV orchestrator] levels of orchestration despite the lack of complete ETSI [European Telecommunications Standards Institute] MANO specifications.

Key takeaways of the report listed by Current Analysis include:

-

Despite debates over MANO functionality apportionment across the open source software (OSS), NFVO and element management system (EMS)/VNFM and incomplete standardization, vendor NFV MANO solutions have made rapid progress over the past year.

- While many NFV deployments employ orchestration at the VIM level only, VNFM-level orchestration is growing and some NFVO-level orchestration is now operational.

- All compared vendors have strong MANO product portfolios, and while some are still monolithic, interoperability with other vendors' NFVI, VIM and SDN controller

offering is generally high.

- Not all vendors have taken the opportunity yet to differentiate their NFV MANO offerings by employing innovative technologies or extending the role of orchestration.

- Not all vendors have taken the opportunity yet to differentiate their NFV MANO offerings by employing innovative technologies or extending the role of orchestration beyond ETSI expectations.

- Vendors vary considerably in the numbers of third-party VNFs supported at VNFM level, although most have taken a proactive approach to developing VNF vendor ecosystems.

- While some vendors now claim the high ground of live NFVO deployments interworking into carriers' OSS, others have not yet reached that point and/or are restricted in disclosing details.

The research firm emphasized that this first report on the MANO topic just establishes a "starting position" in a market destined for a long race determined by many factors.

The other vendors and their rankings are:

-

Amdocs: Competitive

- Cisco: Very Strong

- Ericsson: Strong

- HPE: Very Strong

- Huawei: Strong

- Nokia: Very Strong

- Oracle: Strong

- ZTE: Competitive

"The results of our first solution-level assessment of vendor NFV MANO offerings really reiterates the competitive nature of this space and the ongoing tug-of-war between vendors with network and IT backgrounds,” said Current Analysis exec David Snow in a news release issued by Netcracker.

"This report helps service providers get a head start in their MANO vendor selection process and Netcracker can be proud of its early leadership position," continued Snow, the author of the report. "At the same time, both service providers and vendors should note that this is a long race and there are many factors which will shape the market over the next few years."

About the Author

David Ramel is an editor and writer at Converge 360.