News

Surveys Reflect Rising Interest in Software-Defined WANS, Datacenters

Software seems to be defining everything these days, from networks to storage to complete datacenters and even radios.

Speaking to the rising interest in the software-defined, two new surveys were published this week that specifically target WANs and datacenters.

Regarding the latter, Dell Inc. yesterday published the results of its State of IT Trends 2016 global survey of some 1,200 business and IT decision-makers, referred to in the study as BDMs and ITDMs.

"Eighty-eight percent of ITDMs and 80 percent of BDMs say their organization is considering adopting a software-defined datacenter (SDDC), is in the process of transitioning, or has already completed the transition to one," the company said in announcing the survey results, which were collected by online interviews.

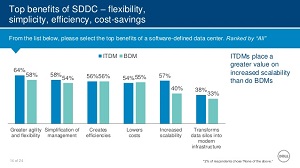

The study revealed some differences in attitude between the two groups of decision-makers. "Global BDMs are more likely to say they are considering adopting SDDC, while global ITDMs are more likely to say they have already started the transition," Dell said. "Both groups agree the benefits of SDDC are flexibility, simplicity, efficiency and cost-savings, although ITDMs also place a greater value on increased scalability (57 percent) than BDMs (40 percent)."

[Click on image for larger view.] SDDC Benefits (source: Dell).

[Click on image for larger view.] SDDC Benefits (source: Dell).

As might be expected, Dell said the study confirms interest in its "customer-driven, compute-centric and software-defined datacenter vision" to meet enterprise business goals. It provided the following supporting evidence:

-

Eight out of 10 respondents agree that a compute-centric approach to datacenter solution development is key in driving innovation.

- More than eight in 10 of those surveyed agree that integrating hyper converged solutions is the first step in achieving a SDDC.

- Decision makers globally say a SDDC is the most important enabler of a digital transformation, more than any other factor asked.

- A hybrid cloud platform is seen as the best place for SDDCs to reside in the future.

- Nearly nine in 10 global decision makers agree that open technology best supports datacenter trends toward application and data portability and broad datacenter-wide process management, compared to proprietary vendor hardware or solutions.

- The ability to address issues quickly is the top global concern for all respondents when it comes to managing the datacenter management.

On a smaller scale, in all respects, Talari Networks, which describes itself as "the trusted SD-WAN technology and market leader," published results of a survey that showed strong interest in software-defined WANs. That interest is so strong that nearly three-quarters of the 400-plus respondents might entertain the possibility of ripping out existing Multiprotocol Label Switching (MPLS) systems with SD-WAN technology.

"The adoption of reliable enterprise networks has begun to take off at full speed as businesses are tired of their network failing over and over during mission-critical scenarios," said company exec Michele Hayes in a statement yesterday. "More and more, we are seeing SD-WAN getting placed in the same budget as the MPLS, WAN OP and Router Replacement budgets. And with nearly 75 percent of the respondents saying they would be willing to replace their MPLS for SD-WAN, IT is starting to make the necessary budget adjustments to acquire this critical technology."

The company further discussed survey results in a blog post.

"As more businesses look to address their critical pain points with an SD-WAN solution, decision-makers are finding that there are multiple approaches to potentially take here," the company said. "Of the businesses that do have SD-WAN in place, nearly half -- 46.7 percent -- are leveraging a hybrid strategy that includes both Internet and MPLS connections. In addition, 22.8 percent utilize Internet only with their SD-WAN, and 20.8 percent have only MPLS in place.

"At the same time, however, more network administrators are considering technology that requires a rip-and-replace approach. Currently, more than 72 percent of companies would examine solutions that demand that MPLS be removed and upgraded with broadband connectivity. Another 24 percent wouldn't consider MPLS alternatives today, but would re-evalulate in the next five years."

Although to be taken with a grain of self-serving salt as always, these and similar surveys do provide some hard numbers to help document the early stages of a transformation in datacenter infrastructure.

About the Author

David Ramel is an editor and writer at Converge 360.