News

Network Agility Drives Software-Defined WAN Adoption, Survey Says

"The motivation for deploying SD-WAN may have started with cost reduction and improved performance, but that's changing."

Network agility -- not lower costs or better performance -- is the deciding factor for enterprises adopting software-defined wide-area network (SD-WAN) infrastructure, according to findings in a survey conducted by Cato Networks.

The Tel Aviv-based 2015 startup published a report titled "The Future of SD-WAN: Peril or Promise?" (free PDF upon providing registration info) based on a survey of more than 350 IT professionals -- with most based in North America -- conducted in March and April. The company said its "thesis" for the report was: "As businesses embrace clouds and hybrid clouds, a new set of requirements merge for how we connect our users, applications and data."

The company said 80 percent of respondents reported increased agility and flexibility using SD-WAN. That finding led to one of the report's key insights, as described by the company: "Agility becomes the deciding factor for SD-WANs."

"The motivation for deploying SD-WAN may have started with cost reduction and improved performance, but that's changing," the report said. "Agility, not cost savings, will be the mantra for tomorrow's SD-WAN. Our research shows that those considering SD-WANs are more apt to prioritize features relating to agility -- reduced deployment and configuration times -- over reduced costs."

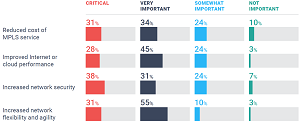

[Click on image for larger view.] Ranking Priorities That Led to SD-WAN Deployments (source: Cato Networks).

[Click on image for larger view.] Ranking Priorities That Led to SD-WAN Deployments (source: Cato Networks).

That observation echoes a similar finding in recent research conducted by Cisco Systems Inc., which investigated general strategies and approaches to SDN and network functions virtualization (NFV) adoption and the development of virtual business services. That research led a Cisco exec to observe: "First and foremost, service providers seek greater agility. They need this to compete more effectively and to respond more rapidly to customer needs and market opportunities."

[Click on image for larger view.] Ranking Priorities Achieved After SD-WAN Deployments (source: Cato Networks).

[Click on image for larger view.] Ranking Priorities Achieved After SD-WAN Deployments (source: Cato Networks).

Cato's report indicated 86 percent of respondents said "increased network flexibility and agility" were either critical or very important priorities that led to SD-WAN deployment. Other factors deemed to be at least very important were "improved Internet or cloud performance (73 percent), "increased network security" (69 percent) and "reduced cost of MPLS service (65 percent).

Other key highlights of the report as identified by Cato include:

- Despite the news to the contrary, MPLS is not disappearing anytime soon.

- Deployment of SD-WANs will fuel investment in network security services.

- Connectivity is only part of an SD-WAN.

- The SD-WAN market is poised for 200 percent growth over the next 12 months.

Cato arrived at the 200 percent growth prediction based on survey results that indicated one in five respondents said their companies plan to deploy SD-WAN in the next 12 months, while one in 10 have already deployed an SD-WAN solution. Also, an additional 30 percent of respondents said their companies are considering SD-WAN, pointing to additional future growth, the company said.

Individual data points of the survey that support the key findings listed above include:

- 60 percent of respondents indicate that their companies have deployed or are considering deploying an SD-WAN.

- 47 percent of respondents indicate no current plans to deploy SD-WANs.

- 30 percent of respondents are holding off on SD-WANs because of issues related to market maturity.

- 53 percent of those who deployed SD-WANs increased investment in network security appliances.

- 62 percent of those implementing SD-WANs report MPLS investment will increase or remained unchanged.

- 41 percent of respondents realized MPLS cost reductions after SD-WAN deployments.

"The SD-WAN market is poised for major growth over the coming years, which will be accompanied by growing pains," Cato quoted 451 Research analyst Jim Duffy as saying. "IT practitioners are still ironing out the wrinkles when it comes to SD-WAN. The technology offers streamlined management and increased network agility, but its cost reduction impact is constrained by the need for increased security and the continued reliance on MPLS. The scope of SD-WAN is likely to expand to address these constraints and enhance customers' return on investment."

Cato provides a namesake Cloud Network, described as "a global, optimized and secure enterprise network backbone" that, among other things, is said to reduce MPLS connectivity costs.

About the Author

David Ramel is an editor and writer at Converge 360.