News

Cloud Spending Explodes as Rivals Chase AWS with Higher Growth Rates

Two recent reports on cloud infrastructure spending show an explosion in an industry still dominated by Amazon Web Services (AWS), although rivals led by Microsoft Azure and Google Cloud Platform (GCP) are beating the kingpin in growth rates.

While the AWS lead is huge, reports indicate the cloud giant's growth rate roughly matches the industry average while several competitors are outpacing it, but they have a long way to go to usurp the champion. In the meantime, they have to settle for bigger pieces of an exploding pie.

"Q4 spend on cloud infrastructure services increased by $2.8 billion over the previous quarter, which is by far the biggest quarterly increment the market has seen," said Synergy Research Group in its report.

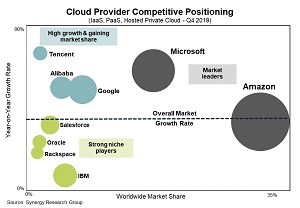

"Amazon growth continued to closely mirror overall market growth so it maintained its 33 percent share of the worldwide market," the company continued. "Second-ranked Microsoft again grew fast than the market and its market share has increased by almost three percentage points in the last four quarters, reaching 18 percent. Behind these two market leaders, Google, Alibaba and Tencent are substantially outpacing overall market growth and are gaining market share."

[Click on image for larger view.] Cloud Provider Competitive Positioning (IaaS, PaaS, Hosted Private Cloud - Q4 2019) (source: Synergy Research Group.

[Click on image for larger view.] Cloud Provider Competitive Positioning (IaaS, PaaS, Hosted Private Cloud - Q4 2019) (source: Synergy Research Group.

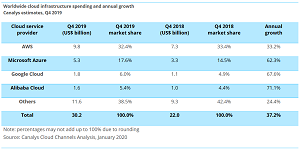

The Synergy report's findings are similar to one announced by Canalys on the same day (Feb 4.). "The worldwide cloud infrastructure services market reached a record high in Q4 2019, as spending grew 37 percent to over $30 billion," Canalys said. "Amazon Web Services (AWS) remained the dominant cloud service provider in Q4 2019, accounting for 32 percent of total spend. Microsoft Azure increased its share to 18 percent from 15 percent in the same period in 2018. Google Cloud was the third largest cloud service provider with an 6 percent share, followed by Alibaba Cloud with 5 percent."

[Click on image for larger view.] Cloud Infrastructure Spending and Annual Growth Canalys Estimates, Q4 2019 (source: Canalys.

[Click on image for larger view.] Cloud Infrastructure Spending and Annual Growth Canalys Estimates, Q4 2019 (source: Canalys.

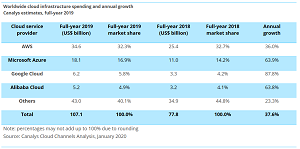

"Total expenditure in 2019 exceeded $107 billion, up from $78 billion in 2018 according to Canalys data," the company said. "This highlights the unrelenting expansion of the IT industry, driven by digital transformation initiatives across all industries. Organizations are increasing their spend on compute, storage and other on-demand cloud-based services to analyze and interpret growing datasets and to meet internal DevOps needs as they build new applications and services.

"

[Click on image for larger view.] Cloud Infrastructure Spending and Annual Growth, Full Year 2019 (source: Canalys.

[Click on image for larger view.] Cloud Infrastructure Spending and Annual Growth, Full Year 2019 (source: Canalys.

Noting the intensified competition, Canalys said AWS' growth will be driven further by factors such as:

- Investment in new enterprise sales and marketing

- New products and initiatives such as AWS Outposts and AWS Local Zones

Azure, meanwhile, benefits from:

- Extensive channel reach

- Partner messaging to move short-lived Windows Server 2008 workloads to the cloud before its end of support life

GCP, fighting for third place, was noted for:

- Finding new enterprise customers

- Developing its own channel partner network

Other highlights of the Canalys statement include:

- The trend toward operating more applications, both new and existing, in public cloud environments, will continue over the next five years

- Organizations will look to take advantage of the unlimited access to capacity, more advanced services, such as AI and analytics, as well as APIs and other tools to accelerate their digital development

- Cloud infrastructure services spending will grow 32 percent in 2020 to $141 billion

- Momentum will continue, with total outlay reaching $284 billion in 2024

- Customer engagement is starting to mature, with more organizations committing to longer-term multi-year agreements with cloud service providers as they move from ad-hoc and uncontrolled use to a more managed and predictable approach

"Organizations across all industries, from financial services to healthcare, are transitioning to being technology providers," said Canalys chief analyst Alastair Edwards. "Many are using a combination of multi-clouds and hybrid IT models, recognizing the strengths of each cloud service provider and the different compute operating environments needed for specific types of workloads.The role of channel partners will become more important, as cloud use increases, in terms of defining application strategies, integration into business processes, optimizing user experiences, governance and compliance, as well as securing data and workloads."

Synergy, meanwhile, noted that while AWS' growth rate matches the industry average, No. 2 Azure showed the largest share gain. Following are Google, Alibaba and Tencent, which all substantially outpaced overall market growth and gained market share, showing revenue increases of 50 percent or more year on year. Chasing that second pack are four other cloud providers -- IBM, Salesforce, Oracle and Rackspace -- that are said to have significant market share but are described as somewhat niche players that typically produce lower growth rates.

"The year ended with a bang as Amazon and Microsoft both posted big sequential gains in cloud revenues,” said John Dinsdale, a chief analyst at Synergy. "Thanks to these two market leaders and strong growth from some other cloud providers, the 2019 market was over twice the size of the 2017 market. Given secular trends in the market we will continue to see strong growth. We will also see a continuing battle for market position between the global giants and smaller cloud providers that have a more focused geographic or service footprint."

About the Author

David Ramel is an editor and writer at Converge 360.