News

AWS Dominates Cloud-Native Study of Kubernetes and Serverless Computing

Research firm SlashData's latest cloud-native study sees Amazon Web Services (AWS) figuring prominently among Kubernetes and serverless developers.

The firm, which publishes an ongoing series of cloud-native computing reports at the behest of the Cloud Native Computing Foundation (CNCF) and just released the latest edition covering Q4 2019, has focused on the Kubernetes and container orchestration system. The CNCF's definition of cloud native says:

Cloud native technologies empower organizations to build and run scalable applications in modern, dynamic environments such as public, private, and hybrid clouds. Containers, service meshes, microservices, immutable infrastructure, and declarative APIs exemplify this approach.

These techniques enable loosely coupled systems that are resilient, manageable, and observable. Combined with robust automation, they allow engineers to make high-impact changes frequently and predictably with minimal toil.

As in most things related to cloud computing, AWS is a leader in the space, the report indicates. For example:

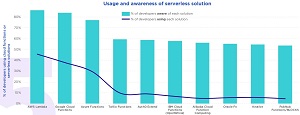

- AWS Lambda continues to be the most used serverless solution with 46 percentof serverless developers using it

[Click on image for larger view.] Serverless Is Dominated by the Top 3 Vendors

(source: SlashData/CNCF).

[Click on image for larger view.] Serverless Is Dominated by the Top 3 Vendors

(source: SlashData/CNCF).

- 62 percentof cloud native developers are using AWS as a cloud hosting provider

- Amazon is the most used cloud vendor among backend developers, both for cloud native (62 percent) and non-cloud native (45 percent)

- Amazon is the most popular vendor with cloud native developers leveraging private clouds, with 52 percentof cloud native developers using it to manage private clouds, compared to 35 percent of non-cloud native developers

[Click on image for larger view.] Private Cloud Usage

(source: SlashData/CNCF).

[Click on image for larger view.] Private Cloud Usage

(source: SlashData/CNCF).

However, there are signs of cracks in the AWS armor in certain segments.

"Compared to Q2 2019, AWS has lost 6 percentage points with cloud native developers, who have shown a small, yet consistent shift (i.e., +2-4 percentage points) towards vendors with smaller cloud communities, such as DigitalOcean, Salesforce, Red Hat, and SAP," the report says. "These patterns suggest that the market is still growing and that there are opportunities for minor vendors to grow their share of the market."

The report also shows an AWS attrition rate of 7 and 8 percentage points among non-cloud native and cloud native developers, respectively.

And also in the serverless arena: "In the last six months, Google has also become significantly more competitive than AWS with UX and UI designers and researchers, with 25 and 32 percentage points advantage over AWS, respectively."

Amazon's position remains strong, though, mirroring many other studies that show eroding AWS leadership even though it continues to place No. 1 across the board.

For example, speaking of the private cloud statistics, the report says: "Nevertheless, AWS continues to hold onto first place. More than 10 percentage points behind AWS, Google (41 percent) and Microsoft (37 percent) are the second and third most competitive cloud service vendors among developers deploying software on private clouds. The difference in the usage of Google and Microsoft by cloud native and other backend developers is 15 and 8 percentage points, respectively."

Other highlights of the report include:

- 6.5 million cloud native developers exist around the globe, 1.8 million more than in Q2 2019

- 2.7 million developers are using Kubernetes

- 9 out of 10 developers using container orchestration tools are aware of Kubernetes

- 4 million developers are using serverless architectures and cloud functions

Methodology of the report was described thusly: "The analysis is based on /Data’s Developer Economics biannual survey of 17,000+ software developers which was fielded between November 2019 and February 2020. 4,179 survey participants answered questions relating to the development of backend services and the technologies they use. This report is based on their responses."

The report can be accessed upon providing registration information here.

About the Author

David Ramel is an editor and writer at Converge 360.