News

Report: Azure Closes on AWS in Hybrid, Multicloud World

Flexera is out with its annual State of the Cloud report, finding Microsoft's Azure platform is closing in on perennial leader Amazon Web Services (AWS) in a cloudscape dominated by hybrid and multicloud implementations.

The report is based on a survey in which respondents reported a strong multicloud presence (noted by 92 percent of enterprises surveyed) and adherence to hybrid strategies (80 percent). While those numbers are high, they are actually down somewhat from last year's report, when the same numbers were 93 percent and 87 percent, respectively.

Flexera says 750 technical pros from around the world covering a broad cross-section of organizations participated in the survey, providing insights into their adoption of cloud infrastructure.

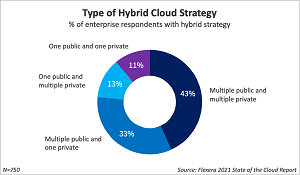

"This year's survey delved into the various cloud combinations used by enterprises with a hybrid strategy," the report says. "Of those enterprises, 76 percent said they're incorporating multiple public clouds, while 56 percent report using more than one private cloud. The most common combination is a mix of various public and private clouds, with 43 percent taking this approach."

[Click on image for larger view.] Hybrid Strategies (source: Flexera).

[Click on image for larger view.] Hybrid Strategies (source: Flexera).

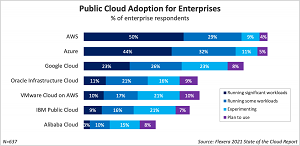

Like other reports, this one measures usage of the competing cloud platforms, which for years have almost always been ranked 1)AWS 2)Azure 3)Google Cloud no matter what metrics were used. That ranking holds true yet again, but Flexera says Microsoft is catching up to AWS.

"It's important to note that adoption -- meaning an organization is using a cloud provider -- is only one factor influencing revenue growth for the provider," the report says. "The survey also explores other factors, including the number of VMs running and PaaS cloud services used. This year respondents were also asked about their level of cloud spend per cloud provider. In 2021, as in previous years, AWS, Microsoft Azure and Google Cloud are the top three public cloud providers."

However, one notable finding in this report is that "Among enterprises, Azure is tied with AWS for breadth of adoption," as shown in this graphic:

[Click on image for larger view.] Public Cloud Adoption (source: Flexera).

[Click on image for larger view.] Public Cloud Adoption (source: Flexera).

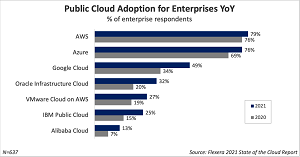

What's more, while both AWS and Azure adoption rates both rose among enterprises, Azure is now at 96 percent of the AWS adoption rate, as shown here:

[Click on image for larger view.] Public Cloud Adoption Year Over Year (source: Flexera).

[Click on image for larger view.] Public Cloud Adoption Year Over Year (source: Flexera).

Other highlights of the report as presented by Flexera include:

- COVID and acceleration of public cloud usage: 31 percent of enterprises spend more than $12 million a year on public cloud. 54 percent of enterprise workloads are expected to be in public cloud in 12 months. 90 percent of respondents who answered a question about COVID-19 expect cloud use to exceed plans due to the pandemic.

- Understanding cloud initiatives and metrics: 61 percent overall plan to optimize cloud costs in 2021, making it the top initiative for the fifth year in a row. 59 percent of advanced users name cloud migration as a key initiative.

- Organizations taking a centralized approach to cloud: 75 percent of enterprises have a central cloud team or center of excellence (CoE). 54 percent of cloud teams are responsible for governing IaaS/PaaS usage and costs.

- Top challenges: security, spend, governance and expertise: Overall, 81 percent indicate cloud security is a challenge, followed by 79 percent for cloud spend and 75 percent for governance.

- Organizations struggle to handle growing cloud spend: Respondents estimate 30 percent of cloud spend is wasted. Respondents aren't taking advantage of all cloud provider discounting options, but adoption is growing. Users are beginning to leverage automated policies to shut down workloads after hours (49 percent) and rightsize instances (48 percent).

- Containers are mainstream: Respondents could pick more than one answer. 54 percent of enterprises (more than 1,000 employees) say they use Docker today, and an additional 22 percent plan to use it. Kubernetes is used by 50 percent, with another 25 percent saying they plan to use. The biggest challenge to using containers are lack of internal resources with expertise (30 percent).

- Public cloud adoption is evolving: Azure continues to narrow the gap with AWS in both enterprises adopting and number of virtual machines (VMs). 16 percent of enterprises (more than 1,000 employees) say they spend more than $12 million a year on AWS; 14 percent for Azure, and 8 percent for Google Cloud.

- Use of public cloud PaaS services increasing: Data Warehouse has the highest adoption, used by 54 percent of enterprises. 28 percent of enterprises are experimenting with machine learning/AI, which is more than any other PaaS services.

- Private cloud adoption: VMware vSphere continues to lead in private cloud (36 percent currently use), Microsoft Azure Stack usage is at 35 percent, and both OpenStack and AWS Outpost are at 28 percent. Private cloud adoption by SMBs is lower overall than for enterprises.

The full report can be downloaded by going here and providing registration information.

About the Author

David Ramel is an editor and writer at Converge 360.