News

DevOps Pros Eye Alternative Cloud Vendors, Payments: Report

DevOps pros are increasingly looking beyond the "Big 3" hyperscaler cloud computing vendors (AWS, Azure and GCP), with new payment mechanisms a prime driver, a recent report finds.

The survey-based report commissioned by cloud hosting specialist Linode (formerly Akami) is titled "DevOps and the Public Cloud: New Ways to Pay for Public Cloud."

The survey backing the report was conducted in April and May by Techstrong Research, which polled 458 development professionals, managers and senior leaders involved with DevOps multi-cloud procurement, operations and strategy across 20 industries as part of a series of reports.

The study indicates the three hyperscaler leaders still have a stranglehold on the cloud computing provider market, but DevOps pros and others now have more options to choose from -- though complete platform replacement isn't always the goal when choosing lesser-known and perhaps niche-oriented vendors and products.

"As the market continues to mature and expand, DevOps teams now have more cloud providers to choose from to handle new and expanded enterprise workloads and multi-clouds," the report said. "More than 90 percent of respondents use cloud services from Amazon, Microsoft or Google. Our research also found significant and growing numbers of companies continuing to opt for smaller, alternative providers. In many cases, these new, smaller vendors are not replacing but augmenting hyperscalers."

Regarding that last point, the research specifically found that nearly one-fifth of organizations selecting an alternative carrier also continued to use services from a hyperscaler, which is "a sensible diversification sure to continue" according to Linode.

In aggregate, 28 percent of respondents reported they used lesser-known alternatives, which makes users of the "The Alternative Cloud" (a term trademarked by Linode) the fourth-largest group, behind AWS (70 percent), Azure (54 percent) and Google Cloud (45 percent). Other offerings were Oracle Cloud (11 percent), IBM Cloud (10 percent), Alibaba Cloud (6 percent) and Rackspace (3 percent).

According to Linode, that represents a significant increase in alternative vendor usage over the past year.

"While Amazon, Microsoft, and Google remain ubiquitous, nearly 75 percent of the surveyed respondents said they were currently using more than one cloud provider, a 20 percent increase from one year ago," said Linode's Mike Maney in a June 23 blog post about the report. "According to Techstrong, 43 percent are considering adding one or more new cloud providers into their cloud mix over the next year."

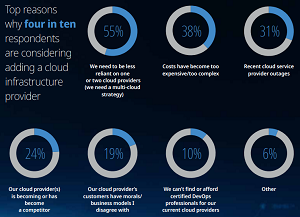

One reason DevOps pros are looking for alternatives is that they're afraid their current provider will become a competitor. In fact, 22 percent of respondents reported that was a concern, while 25 percent said the current providers already were competitors. Fifty-three percent of respondents said that wasn't a concern. Other reported concerns included optionality, costs, uptime and ethics.

[Click on image for larger view.] Why Considering a Change (source: Linode/Techstrong).

[Click on image for larger view.] Why Considering a Change (source: Linode/Techstrong).

Paying for Cloud: Credit Cards and Formal Contracts Rule -- for Now

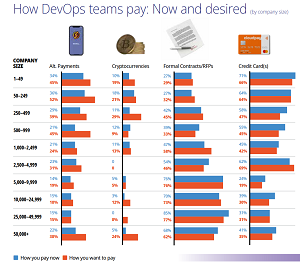

As noted, a second key highlight of the report concerns alternative payments support in the cloud, about which small and very large businesses are most enthusiastic, along with younger folks like those described as Gen Z (which some sources say refers to people born from the mid-to-late-1990s through the 2010s).

[Click on image for larger view.] Existing and Desired Payment Options (source: Linode/Techstrong).

[Click on image for larger view.] Existing and Desired Payment Options (source: Linode/Techstrong).

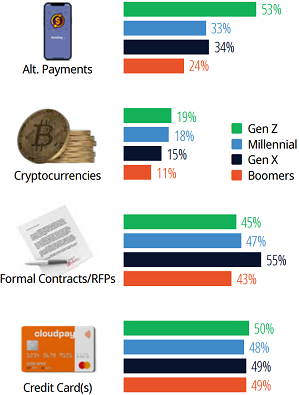

"More than half of DevOps respondents who self-identify as Gen Z want to pay for cloud services with PayPal, Venmo, Apple Pay, Google Pay and other alternatives," the report said. "The numbers decline steadily with other age cohorts, bottoming out with fewer than half of Baby Boomers. That's not a huge surprise given the spending preferences of younger consumers. It's a clear reminder of where demographics are pushing things. Desire to pay with cryptocurrencies also is notable, though roughly half that of alternatives. Enthusiasm here follows a similar downward trajectory based on age. Interestingly, Gen Xers are most comfortable with formal contracts, Boomers the least."

[Click on image for larger view.] Payment Preferences (source: Linode/Techstrong).

[Click on image for larger view.] Payment Preferences (source: Linode/Techstrong).

However, while there's a strong interest in certain camps for alternative payments, the Big 3 establishment hasn't quite come around, sporting a spotty support posture so far.

"Of course, talk about and desire for alternate payment methods and crypto isn't worth much if cloud providers don't accept them," the report said. "The current landscape is what you might expect: Almost every vendor takes credit cards from the majors and some smaller issuers like UnionPay and Diners. Ditto for widespread ability to accept wire transfers. Many vendors offer various pre-paid and contractual models. Acceptable payment methods can vary by region. Perhaps more surprisingly (or not), the only alternative payment that's somewhat widely accepted is the most established: PayPal. But not by the Big Three. Google Pay is a distant second. (Ironically, you can't use it to pay for Google Cloud Platform.) Of all the providers in our study, only Vultr, an alternative, offered a choice of alternative payments and cryptocurrencies in addition to credit cards."

Techstrong Research said many organizations believe it's worth looking beyond the "cool" factor of alternatives and practicing due diligence via a cost/convenience/benefit analysis of adopting alternative and crypto payments for cloud infrastructure and services. If business concerns dictate such a move, the firm advises opening up a dialogue with existing or target vendors on how to undertake it.

"Whether you're a skeptic or supporter, it's clear: Alternative payments are gaining traction with DevOps in a wide variety of companies," Techstrong said in the report's bottom-line conclusions. "Many seek the promise of greater convenience, security and savings from the direct and indirect costs of using credits cards and processing RFPs and POs.

"The enthusiasm for alternate payments voiced by younger respondents may be passing, or at present lack the clout to broadly shift industry practices. But if, in fact, 'demography is destiny' and providers are serious about listening to the voice of customers worldwide and improving their experience, alternative payments for cloud infrastructures and services are headed for wide acceptance."

About the Author

David Ramel is an editor and writer at Converge 360.