News

VMware Named SD-WAN 'Leader' for Fifth Straight Year

Virtualization kingpin VMware continues to dominate the software-defined wide-area networking (SD-WAN) space, according to the latest Magic Quadrant report from research firm Gartner.

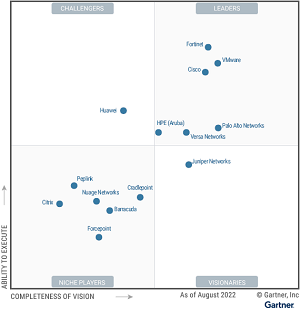

"We expect this vendor to make continued investments in delivering services from its cloud gateways, integrating with home Wi-Fi solutions, supporting zero trust at the edge and improving throughput offerings," Gartner said in its new "Magic Quadrant for SD-WAN" report, which for the fifth straight year placed VMware in the "Leaders" section of the report, which categorizes vendors into four sections -- also including Visionaries, Niche Players and Challengers -- and ranks them on axes for "Ability to Execute" and "Completeness of Vision."

In fact, VMware is tied with Palo Alto Networks atop the vision axis, while it's behind only Fortinet on the execution axis.

[Click on image for larger view.] Magic Quadrant for SD-WAN (source: Gartner).

[Click on image for larger view.] Magic Quadrant for SD-WAN (source: Gartner).

"Its offering is VMware SD-WAN, which includes edge appliances, optional gateway points of presence (POPs) and a cloud-based orchestrator," Gartner said. "VMware also offers optional SASE cloud security capabilities, of which VMware SD-WAN is a part. The vendor's operations are global, and it serves clients of all sizes and in all vertical industries. VMware is based in California, and Gartner estimates that it has more than 17,000 SD-WAN customers."

VMware acknowledged its five-year reign of Magic Quadrant SD-WAN prowess in a Sept. 15 blog post, in which it discussed how enterprises are digitally transforming to support their remote workforces.

"Enterprises are modernizing their businesses to increase agility and remain competitive in today's market by transforming applications, adopting cloud or SaaS, and allowing users to access these applications from the office, home, or anywhere," VMware said. "What is their goal? Users must have the same application experience regardless of whether they are inside or outside the office; ensure security of their network, applications, and data; and support the next generation of applications demanded by enterprise's business lines."

As for the market in general, Gartner described it thusly: "SD-WAN products replace traditional branch routers. They provide dynamic path selection, based on business or application policy, centralized policy and management of appliances, virtual private network (VPN), and zero-touch configuration. SD-WAN products are WAN transport-/carrier-agnostic, and create secure paths across WAN connections. SD-WAN products can be hardware-/software-based, managed directly by enterprises or embedded in a managed service offering."

The research firm based its report on three strategic planning assumptions:

- By 2025, 50 percent of new software-defined WAN (SD-WAN) purchases will be part of a single-vendor secure access service edge (SASE) offering, which is a major increase from 10 percent in 2022.

- By 2026, 30 percent of new SD-WAN procurements will be in some form of network as a service (NaaS), which is a major increase from near 0 percent in 2022.

- By 2025, 40 percent of enterprises with SD-WAN deployments will use artificial intelligence (AI) functions to automate Day 2 operations, compared with fewer than 10 percent in 2022.

As far as future trends of the SD-WAN market, Gartner listed:

- AI Networking: There is a trend to more autonomous and self-driving networks in which AI/ML technologies can be leveraged to make networking decisions without or with limited human intervention.

- Convergence of Five Adjacent Technologies: Formerly, applications were hosted in the data center, and demarcation points were the branch to the data center and the organization had control over the data center. With the move of more applications to the cloud (SaaS, IaaS and PaaS), we have identified five adjacent markets that we envision converging: SD-WAN, SSE, enhanced internet, cloud onramp and multicloud networking software.

- Single-Vendor SASE: The current SASE market is dominated by multivendor solutions with some type of orchestration tying it together. We expect to see more single-vendor, integrated SASE solutions incorporating the SSE and SD-WAN branch components. We also expect to see new pricing models from relevant vendors. This will simplify sourcing and offer a tighter technical integration, ultimately offering a better user experience.

- The Cloud Provider Becomes My WAN Vendor: More workloads are moving to the cloud and enterprises are becoming more cloud-first. As a result, we see cloud service provider network backbones becoming part of an enterprise's WAN solution -- not only for connecting to cloud workloads and potentially between workloads, but also to connect branch locations, headquarters and remote workers.

- NaaS: While not specific to SD-WAN per se, we do see new consumption options that can take advantage of a pure usage/metered/consumption model in terms of per user or unit of bandwidth, in addition to typical subscription models. NaaS incorporates hardware, software and management as a consumption model where the customer doesn't own the equipment. It includes turnkey self-service and elastic demand options, including network refreshes to simplify consumption.

While Gartner usually charges for its research, Magic Quadrant reports are typically available from several covered vendors in licensed-for-distribution editions that can be found with a quick web search.

About the Author

David Ramel is an editor and writer at Converge 360.