News

Research: AWS Edges Ahead in Cloud Database Management Systems

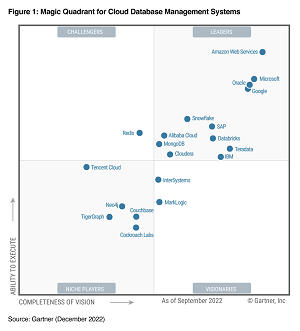

Research firm Gartner's "Magic Quadrant" series of reports on cloud database management systems has long seen a crowded "Leaders" field populated with the usual cast of cloud giants and wannabes, but this year AWS has slightly edged ahead of the pack.

"AWS is the world's largest cloud database service provider by revenue, coming to this leading position barely a decade after the first of these services were introduced," says the new Magic Quadrant for Cloud Database Management Systems report. "AWS has the underlying infrastructure to support its leading position, and includes the largest base of production users in the industry."

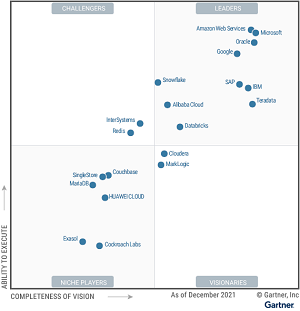

The graphics below show show how AWS has edged into the lead since the 2021 report, now topping both the "Ability to Execute" and "Completeness of Vision" axes.

[Click on image for larger view.] 2022 Gartner Magic Quadrant for Cloud Database Management Systems (source: Gartner).

[Click on image for larger view.] 2022 Gartner Magic Quadrant for Cloud Database Management Systems (source: Gartner).

[Click on image for larger view.] 2021 Gartner Magic Quadrant for Cloud Database Management Systems (source: Gartner).

[Click on image for larger view.] 2021 Gartner Magic Quadrant for Cloud Database Management Systems (source: Gartner).

AWS trumpeted its ascension and inclusion as a "Leader" for the eighth straight year in its own blog post.

Overall, Gartner's report points to a maturing cloud DBMS space, with the reports market overview stating, "There has been a general lifting of capabilities across the market. Whereas in the last two to three years, the emphasis has been moving to the cloud, often with basic capability, this last year has seen a marked maturing of the majority of offerings."

The report also includes several bulleted data points:

- By 2025, 90 percent of new data and analytics deployments will be through an established data ecosystem, causing consolidation across the data and analytics market.

- Through 2024, organizations that adopt aggressive metadata analysis across their complete data management environment will decrease time to delivery of new data assets to users by as much as 70 percent.

- The overall database management system (DBMS) market saw strong growth of 22.3 percent in 2021 to reach $80.3 billion.

- The 2021 growth in this market is an expansion of its 2020 growth of 17.1 percent, and exceeds the overall software market growth rate of 16 percent.

- The overall DBMS market is on course to be a $100 billion market by 2023. This was primarily driven by cloud database platform as a service (dbPaaS), whose share has reached nearly 50 percent of the overall 2021 market.

- For 2021, greater than 84 percent of the overall DBMS market growth came from dbPaaS.

- Database software now accounts for 12.9 percent of the overall software market.

Continuing to explain the market's maturation, Gartner said: "In prior years, for analytical databases, the ability to access remote databases, invoke machine learning, incorporate low-code capability, provide efficient workload management and operate multimodel were seen as advanced -- yet now they are standard parts of many offerings. For operational systems, the ability to do distributed transactions across many processors and geographic areas and to take advantage of hyperscale architectures is now normal. For both types of systems, elastic scalability, SQL support (including for nonrelational databases) and the ability to mix operational and analytical working is becoming business as usual. Thus, all enterprises now have easier access to a wide range of database capabilities."

The report also heavily features the term "data ecosystem" mentioned in bullet point No. 1 in the above list.

"The trend toward data ecosystems continues," the report said. "A data ecosystem occurs where a provider competes not just on a point solution for a particular service (for example, data warehouse, data lake or ML), but instead on the way in which multiple services are integrated. Data ecosystems will usually comprise components from a single vendor but can be constructed by the interfacing of multiple vendors' products. This interoperability is likely to be seen as a strategy for smaller vendors. We expect to see this feature much more prominently from 2023 onwards."

Gartner also used the term in one of its "cautions" about the new, clear leader, AWS. Noting an "AWS-Centric Focus," the Gartner caution reads: " AWS has traditionally not concerned itself with data outside its cloud. But as multicloud becomes standard for enterprises, regardless of its necessity for individual business units, AWS' traditional lack of focus on non-AWS systems in the data ecosystem can be a concern for customers looking at the current product stack."

Other cautions for AWS include:

- Integration of Services: AWS uses a best-fit approach to database services, which enables it to deliver focused solutions for different types of use cases. But multiple services also require integration of those services, so AWS has to offer a more robust solution to bring the different services together in its current offering.

- Complexity of Setup and Management: AWS offerings can be complex to keep all the parts working together in sync, especially in the initial setup. However, AWS aims to deliver the best toolbox in the market, with a best-of-fit approach for flexibility.

AWS's strengths, meanwhile, were:

- Leading Market Presence: AWS is the world's largest cloud database service provider by revenue, coming to this leading position barely a decade after the first of these services were introduced. AWS has the underlying infrastructure to support its leading position, and includes the largest base of production users in the industry.

- Breadth of Services: AWS believes in a best-fit philosophy, offering multiple services targeted to specific use cases as needed by various applications and microservices. This focus has led to the development of more than a dozen database management services. Collectively, these services offer an unparalleled set of functionalities.

- Progress Toward Integration Roadmap: The AWS roadmap has changed to offer solutions that will address integration of both its wealth of services and the world outside of AWS at multiple levels of the stack. The tendency of AWS to only focus on its own platform has been a detriment in the past, but its changing direction is directly addressing this to turn it into a strength.

Gartner's Magic Quadrant reports are typically offered up for free in licensed-for-distribution copies from vendors that are covered, easily found with a quick web search.

About the Author

David Ramel is an editor and writer at Converge 360.