News

Sovereignty Joins AI as the New Hyperscaler Battleground in 2025

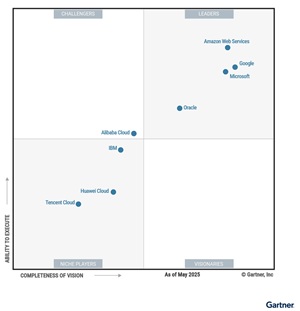

Although the leaders in Gartner's new research report on strategic cloud platform services basically remain the same -- AWS for the 15th consecutive year -- the hyperscaler space is reflecting geopolitical changes that may be more important than tech-spec rankings.

Gartner says organizations are no longer picking hyperscalers based only on technical features, but on whether the provider can be trusted as a long-term strategic partner in a changing world.

These changes cited by the research firm might supersede the usual examination of tech and specs from cloud service providers that number only eight this year, led by the usual suspects, AWS, Microsoft and Google.

In fact, Gartner wastes no time getting to this salient observation in its new Magic Quadrant for Strategic Cloud Platform Services report. It lists the relevant factors immediately in the first sentence: "Digital sovereignty, AI and cloud resilience are among the new trends shaping how organizations select a public cloud provider in 2025."

Digital/Cloud Sovereignty

The report defines sovereignty as central to evaluating hyperscaler partnerships in a time of geopolitical upheaval. Gartner writes: "Beginning in 2025, geopolitical instability has led IT leaders in both public and private sectors to assess dependencies on global public cloud hyperscalers. As alternatives are often disruptive, cloud sovereignty is gaining traction as a target for geopatriation."

For enterprises, that means the same vendors racing ahead with generative AI and platform services are also under pressure to prove they can guarantee local control of data, compliance with regional regulations, and resilience under shifting global conditions. That combination -- AI innovation on one hand and sovereignty assurances on the other -- now frames the competitive landscape for strategic cloud platforms.

Further speaking to the changes in this space, Gartner just within the past few years changed the MQ report series from Cloud Infrastructure and Platform Services (CIPS) to Strategic Cloud Platform Services (SCPS) to better reflect the evolving market dynamics and the increasing importance of strategic considerations in cloud adoption.

Regardless of the name, the leaders have long looked much like this:

[Click on image for larger view.] Magic Quadrant for Strategic Cloud Platform Services, 2025 (source: Gartner).

[Click on image for larger view.] Magic Quadrant for Strategic Cloud Platform Services, 2025 (source: Gartner).

For comparison, the 2020 CIPS Magic Quadrant looked like this:

[Click on image for larger view.] Gartner 2020 Magic Quadrant for Cloud Infrastructure and Platform Services (source: Gartner).

[Click on image for larger view.] Gartner 2020 Magic Quadrant for Cloud Infrastructure and Platform Services (source: Gartner).

Geopatriation and Market Disruption

What Gartner highlights as new is not just the presence of sovereignty requirements, but the way they are disrupting how hyperscalers compete. The firm says the market has consolidated around just eight providers controlling more than 97 percent of cloud infrastructure and platform services. In that environment, sovereignty pressures have become a way for customers to push back against overdependence, driving demand for sovereign regions, locally managed deployments, and stricter data residency options.

The concept of "geopatriation" reflects this shift, describing the effort by enterprises and governments to pull critical digital operations back under regional or national control. Rather than replacing hyperscalers outright -- a move Gartner acknowledges is often too disruptive -- organizations are forcing vendors to adapt by embedding sovereignty features directly into their global offerings. That makes sovereignty not just a compliance issue, but a competitive lever in the hyperscaler race.

AI as Parallel Battleground

Alongside sovereignty, Gartner identifies AI as another defining competitive arena for hyperscalers. The report notes that "the race for preeminence in generative AI has resulted in a deluge of new GenAI services from all providers, based on both NVIDIA and proprietary hardware designs." That surge is reshaping platform strategies, as vendors compete to differentiate with custom silicon, foundation models, and integrated AI services across their cloud portfolios.

For customers, this means that sovereignty and AI are converging priorities. Organizations want the innovation that comes with rapidly evolving AI platforms, but they also expect those services to meet sovereignty requirements. As a result, hyperscalers are tailoring AI capabilities to operate in sovereign regions, with controls for data residency, customer-managed encryption, and regulated industry use cases. AI may provide the growth engine, but sovereignty is increasingly the condition under which it can be adopted.

Cloud Resilience

The third element Gartner puts forward alongside sovereignty and AI is cloud resilience. In this context, resilience goes beyond uptime SLAs to include the ability to withstand supply chain stresses, capacity shortages, and geopolitical disruptions. Gartner points to features such as multi-region failover, automated replication of resources and data, and distributed architectures as critical differentiators.

Recent shortages of GPU hardware and uneven capacity across regions have already shown how fragile global supply lines can affect cloud adoption. For enterprises, resilience has become as much a strategic requirement as a technical one: IT leaders need confidence that their provider can maintain service continuity under adverse conditions. That expectation forces hyperscalers to demonstrate not only innovation in AI and sovereignty controls, but also the operational scale and redundancy to keep critical workloads running worldwide.

Leaders Comparison

The table below highlights how the big four "Leaders" hyperscalers address sovereignty, AI, and resilience, based son Gartner's 2025 SCPS MQ report:

| Provider | Sovereignty | AI | Resilience |

| AWS | Sovereignty features included as part of common SCPS market capabilities: data residency controls, customer-held encryption keys, and locally managed or autonomous regions. | Custom silicon (Graviton, Trainium, Inferentia) and a "marketplace" approach to GenAI via Bedrock, including partnerships and first-party models. | Strong operational execution with a long record of availability; effective navigation of supply chain disruptions and GPU demand. |

| Microsoft | Sovereignty addressed through Azure Local and Azure Arc offerings, enabling governance across regions and multicloud; report notes capacity shortages in some regions. | First to integrate GenAI services through its OpenAI partnership, embedding Copilot across Microsoft 365, Dynamics, and Azure. | Unified control plane across on-premises, edge, and multicloud environments; some customer concerns over purchasing complexity. |

| Google | Partner-operated sovereign offerings: Data Boundary, Dedicated regions, and air-gapped solutions. | Strengths in custom silicon (TPUs), Gemini foundation models, and Agentspace for AI agents and enterprise search. | Distributed cloud and advanced data center design for resilience; some concerns noted about support consistency outside North America. |

| Oracle | Wide sovereignty portfolio: standard, private, sovereign, and partner-operated regions; consistent pricing across environments. | High-performance AI infrastructure with OCI Superclusters; embedding GenAI into Oracle applications. | 51 regions in 26 countries with no-egress multicloud interconnects; Gartner cautions over transparency following a breach. |

What emerges from Gartner's analysis is that the hyperscalers are no longer competing on infrastructure and platform breadth alone. Instead, their approaches to sovereignty, AI, and resilience serve as indicators of whether they can be trusted as long-term strategic partners. For enterprises, that shifts the evaluation lens away from technical checklists toward questions of governance, compliance, and operational durability in a volatile global environment.

Why It Matters for Cloud IT Pros and Developers

For practitioners working in the cloud, Gartner's findings underline that the context of cloud adoption is shifting. Decisions once made primarily on performance, features, and cost are now intertwined with sovereignty, AI integration, and resilience. Developers will encounter sovereignty-driven constraints on where and how data can be processed, while IT leaders will weigh vendor roadmaps not only for innovation but for assurances of regulatory compliance and service continuity.

As Gartner puts it, customers are "moving beyond technical evaluations to assess how well each vendor can serve as a strategic partner on their long-term cloud computing journey." In practical terms, that means hyperscalers must demonstrate they can deliver cutting-edge AI while respecting sovereignty requirements and maintaining resilience under pressure. For enterprises, the outcome is clear: cloud strategy is no longer just about technology -- it's about trust in the provider to remain a stable, compliant, and innovative partner over the long haul.

While Gartner usually charges paid clients for its research, the Magic Quadrant series is typically allowed to be distributed by covered vendors in licensed-for-distribution editions, easily found with a quick web search.

About the Author

David Ramel is an editor and writer at Converge 360.