News

Cloud Computing Survey Shows Cost Control Struggles

Cloud computing surveys usually reveal that security concerns and lack of in-house skills are top impediments to successful implementations, but a recent poll adds a new top challenge: cost control.

That revelation comes in the new 2022 Cloud Computing Survey from Foundry (formerly called IDG Communications), which sheds light on the practices and opinions of 850 IT decision-makers (ITDMs) involved in the purchase process for cloud computing and whose organization has, or plans to have, some application or infrastructure presence in the cloud.

As we have repeatedly reported, the continuing skills gap is often the top challenge listed by respondents -- along with security concerns, which are always top-of-mind. In the new Foundry report, however, challenges with cost control are right up there with those two perennial concerns, even eclipsing them.

"When it comes to implementing a cloud strategy, top challenges are controlling cloud costs (36 percent), data privacy and security challenges (35 percent) and lack of cloud security skills/expertise (34 percent)," Foundry said in an April 7 news release.

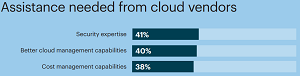

[Click on image for larger view.] Vendor Help Wanted (source: Foundry).

[Click on image for larger view.] Vendor Help Wanted (source: Foundry).

And, not only did respondents identify cost control as the No. 1 challenge to cloud computing, it also figures in highly when respondents revealed what assistance they sought from their cloud vendors: "When asked what ITDMs needed most from their future or current cloud providers, leading the list is security expertise (41 percent), followed by better cloud management capabilities (40 percent) and cost management capabilities (38 percent)."

The report adds more detail. "Virtually all ITDMs (96 percent) have experienced significant challenges to implementing their cloud strategy," it says. "One major issue is cost control, including:

- challenges in controlling cloud costs (36 percent)

- cost of moving data into and between clouds (25 percent)

In contrast, those other significant challenges were reported by smaller percentages of respondents:

-

Security management:

- Data privacy and security challenges (35 percent)

- Lack of cloud security skills/expertise (34 percent)

- Securing and protecting cloud resources (25 percent)

-

Skills gap:

- Lack of cloud management skills/expertise (33 percent)

- Difficulty finding staff with cloud development skills/expertise (30 percent) -- even though roughly 8 in 10 have added an average of 3.3 new roles and functions as a result of their cloud investment

Other data highlights of the report include:

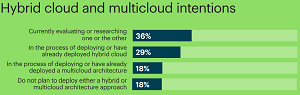

- With respect to hybrid cloud and multicloud intentions, 36 percent of respondents are currently evaluating or researching one or the other:

[Click on image for larger view.] Hybrid/MultiCloud (source: Foundry).

[Click on image for larger view.] Hybrid/MultiCloud (source: Foundry).

- Top drivers for cloud investment are to enable disaster recovery and business continuity (40 percent) and to replace on-premise legacy systems (39 percent)

- The majority (69 percent) of companies have accelerated their cloud migration over the past 12 months, and the percentage of companies with most or all IT infrastructure in the cloud is expected to leap from 41 percent today to 63 percent in the next 18 months

- 52 percent of ITDMs say they consider Software-as-a-Service the biggest cloud growth area, followed by Platform-as-a-Service (38 percent), Security-as-a-Service (37 percent) and Infrastructure-as-a-Service (36 percent)

- 72 percent of ITDMs say that their organization is defaulting to cloud-based services when upgrading or purchasing new technical capabilities

- 69 percent of ITDMs agree that their organization has accelerated its migration to the cloud over the past 12 months

- Only 16 percent of organizations rely on a single cloud provider for their public cloud deployments

Finally, the report lists conclusions for tech marketers based on all that data.

- Cloud budgets continue to increase -- on average, organizations will spend $78 million on cloud computing over the next 12 months, which is up from $73M in 2020.

- Software-as-a-Service, Platform-as-a-Service, Security-as-a-Service, Infrastructure-as-a-Service, and cloud-based analytics are considered to be the top cloud growth areas for 2022. However, these areas differ by company size and industry. Be sure to understand your target audience and provide them with the resources they need to stay up-to-date on these trends.

- Organizations are defaulting to cloud-based services when upgrading or purchasing new technical capabilities. It's important to have a grasp on what business objectives are driving their cloud investments.

- As in every aspect of the business, security remains top of mind when investing in cloud solutions. The number one business driver for cloud computing is to enable disaster recovery and business continuity, while data privacy and security challenges are one of the top obstacles to implanting a cloud strategy.

- Despite the benefits organizations see from the cloud, a variety of challenges still get in their way, mostly around cost control, security expertise and a skills gap. Provide solutions to your customers and prospects to combat these challenges.

"Although enterprise businesses are leading the charge, SMBs aren't far behind when it comes to cloud migration," said Founddry exec Stacey Raap. "As more organizations move their organizations towards fully being in the cloud, IT teams will need the proper talent and resources to manage their cloud infrastructure and overcome any security and privacy hurdles that come with being in the cloud."

The survey, the ninth in a series, was fielded in February.

About the Author

David Ramel is an editor and writer at Converge 360.