News

Microsoft Has a Healthy Q4

The Nokia influence dragged profits down, however.

The two leading virtualization companies reported on their latest quarterly earnings yesterday. VMware showed a healthy profit for its 2014 Q2, and Microsoft did well, too.

For Microsoft, it was Q4 earnings. It missed earnings per share expectations by about $0.05, but beat overall revenue expectations.

Microsoft reported earnings per share of $0.55 and revenue of $23.38 billion for the quarter, which ended on June 30. Wall Street consensus expectations for this quarter were $0.60 earnings per share and $22.09 billion in revenue. Microsoft's overall revenue for the quarter was up 18%, year over year.

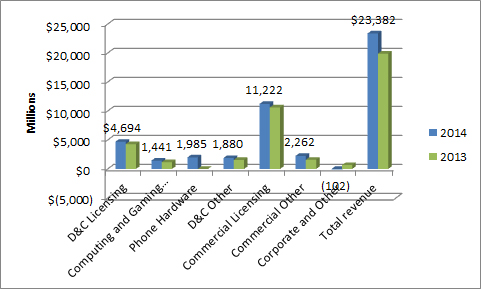

Microsoft has seven reporting segments (see Table at end for definitions), with Microsoft tweaking the reporting structure a bit for this quarter. Overall, those segments outperformed the year-ago quarter (see Figure).

Microsoft's fiscal Q4 2014 revenues by segment. Source: Microsoft investor relations site.

Microsoft's fiscal Q4 2014 revenues by segment. Source: Microsoft investor relations site.

Microsoft's Commercial Other business unit increased revenue by 44% due to Office 365 and Microsoft Azure, according to Microsoft's earnings report. Enterprise Services revenue grew 11% due to Premier Support Services growth.

Devices and Consumer (D&C) revenue increased 42% overall, with D&C Licensing revenue contributing 9%. Windows OEM revenue increased 3%. Office consumer revenue increased 21%.

This Q4 report included Nokia earnings for the first time. Microsoft acquired the company for $7.2 billion on April 25, 2014. Microsoft now reports Nokia earnings in a new D&C segment called "Phone Hardware." Nokia contributed $1.99 billion in revenue to Microsoft, but it had a negative influence on earnings per share (down $0.08).

In addition, Microsoft renamed its D&C Hardware segment, which is now called "Computing and Gaming Hardware." It had 23% increased revenue, based on Surface and Xbox sales, according to Microsoft. Surface generated $409 million.

Leading up to its Q4 report, Microsoft had announced its biggest layoffs yet, cutting 18,000 employees or about 14 percent of its overall workforce, predominantly affecting its 25,000 newly acquired Nokia workers. The financial press noted a 5% stock uptick in reaction to that announcement. The layoff will cost "between $1.1 billion and $1.6 billion" in Microsoft's fiscal-year 2015, the company estimated. The layoff rationale wasn't discussed during Microsoft's earnings call and no financial analyst asked about it.

There were other cost-cutting efforts taken before this earnings release as well. For instance, Microsoft indicated that it is planning to close its Xbox Entertainment Studios, according to an internal memo, and it heavily suggested that it will reduce its hosted tradeshow presence next year.

While Microsoft has tended to beat Wall Street estimates most quarters, its recent cost-cutting measures appear to be an effort to please some investors. New Microsoft CEO Satya Nadella now faces a board of directors that includes ValueAct Capital Management, which joined the board in August of last year. ValueAct is credited by Reuters as having worked to oust former CEO Steve Ballmer.

Some analyst firms, such as Stock Traders Daily, have claimed that Microsoft's growth rates have been declining since 2010.

| Business |

Segment |

Summary |

| Devices and Consumer |

- Licensing

- Computing and Gaming Hardware (renamed from "Hardware")

- Other

- Phone Hardware (new)

|

Includes Windows and Office 365 (OEM and non-volume licensing); Xbox, Surface, and PC accessories; Windows Store, Windows Phone Store, Xbox Live, Office 365 Home, and Office 365 Personal, video games; Nokia business |

| Commercial |

|

Includes server products, Windows volume licensing, Microsoft Office for businesses, CALs, Microsoft Dynamics (except for Dynamics CRM Online), Skype; Premier Support Services and Microsoft Consulting Services, Office 365 services excluding consumer offerings, Dynamics CRM Online and Microsoft Azure |

| Corporate and Other |

-- |

Corporate activity; costs and operating expenses |

Microsoft's business units, including a new Phone Hardware segment that reports Microsoft's Nokia business, as well as a Computing and Gaming Hardware segment (renamed from "Hardware"). Source: Microsoft's Form 10-Q, along with its July 18 announcement of reporting changes.

|

About the Author

Kurt Mackie is senior news producer for 1105 Media's Converge360 group.