In-Depth

Threats on Every Side

VMware faces intense competition in the market, from competing products and huge vendors like Microsoft, Citrix and Google.

- By Dan Kusnetzky

- 08/26/2016

VMware faces intense competition in the market, from competing products and huge vendors like Microsoft, Citrix and Google. In addition, its cash cow -- the vSphere hypervisor -- is slowly dying. Can it successfully fight off its challengers?

VMware Inc., like a number of very large IT suppliers, is competing in numerous technology markets. In a way, that's a bit like trying to ride a number of horses simultaneously up an ever-moving stream of change. Trying to stay on top of any of those horses is challenging. Riding a number at the same time and staying ahead of competitors takes both skill and talent.

VMware is positioning itself as the king of virtualization technology and has a strong position in enterprise cloud computing. The company has also staked out positions in Web application development, application availability, and disaster prevention and recovery.

Although VMware has entries in a number of markets, it's still largely thought of as a supplier of virtual machine (VM) software and both management tools for that software and related, supporting technology.

If you deconstructed the company's virtualization product portfolio using the Kusnetzky Group model of virtualization, you'd see the following:

Access Virtualization

VMware's access virtualization technology is made available as components inside of AirWatch, Horizon Air and Horizon 7 (see Figure 1). For the most part, VMware's offerings in this space are designed to support controlled and distributed access to applications and virtual systems executing in VMware's own environment, rather than as a set of general-purpose tools to support access broadly.

[Click on image for larger view.]

Figure 1. Application virtualization and management is a core function for VMware.

[Click on image for larger view.]

Figure 1. Application virtualization and management is a core function for VMware.

VMware's access virtualization tools are designed to support a limited number of client devices, rather than to emulate the Citrix Systems Inc. "connect anything to anything" strategy. Quite often, VMware's tools in this area are delivered as part of a bigger package rather than as a separate tool.

Application Virtualization

VMware's application virtualization technology is made available as a component of AirWatch, the Horizon family of products and Desktop ONE. Once again, VMware's offerings in this category are meant to package and deliver applications designed to execute in a VMware environment. Then they're delivered to a specific set of client devices, rather than as a general-purpose set of tools designed to free applications from Windows, Apple OS X and other popular computing environments and make it possible for them to execute anywhere, on any type of device. Quite often, VMware's tools in this area are delivered as part of a bigger package, rather than as a separate tool.

Processing Virtualization

This is where VMware started, and remains the company's greatest area of strength. The company began by offering VM software designed to create virtual environments operating on industry-standard x86-based systems. The company chose the name VMware as a way to honor IBM's VM product family, and to help customers understand that VMware's products might be new, but they were based on sound ideas that had been in use in enterprise datacenters since the mid-1960s.

VMware's processing virtualization technology is made available as a component of vSphere and vCloud, as well as part of a personal desktop product line that includes Fusion, Fusion Pro, Workstation Player and Workstation Pro. These tools, while extremely popular, are often seen as expensive and bound by both licensing and terms and conditions often seen as restrictive. These products are marketed as if they are the only entries into the markets they serve.

Storage Virtualization

VMware's storage virtualization technology is made available as part of its Virtual SAN (VSAN), Site Recovery Manager, hyper-converged software, and EVO SDDC (software-defined datacenter, Figure 2). These tools are designed to support VMware-centric computing environments, and cannot be seen as general-purpose tools such as those offered by others.

[Click on image for larger view.]

Figure 2. EVO SDDC underlies VMware's software-defined strategy.

[Click on image for larger view.]

Figure 2. EVO SDDC underlies VMware's software-defined strategy.

Network Virtualization

VMware is offering network virtualization technology to support its virtualized environment. Its primary use is in NSX, its software-defined networking tool; it's also in VSAN, Site Recovery Manager, hyper-converged software and EVO SDDC.

As with VMware's storage virtualization tools, its network virtualization tools are designed to support VMware-centric computing environments and may not support heterogeneous computing environments.

Management of Virtual Environments

VMware's management tools are made available as part of vSphere with operations management, Site Recovery Manager, Identity Manager, vRealize Suite, vRealize Operations, vCloud Suite and AirWatch. As with many of its other tools, they all fit neatly into a VMware-centric environment.

If an enterprise is operating a mixed environment that includes mainframes and midrange computers, and supporting environments based open virtualization products from other suppliers, it will need other tools, in addition to those offered by VMware, to create a well-managed environment.

Security for Virtual Environments

VMware's security technology is focused on addressing the needs of NSX, vSphere, vCloud, the Horizon family of products and AirWatch products. These tools, as with most of VMware's other products, are designed with a VMware-centric computing environment in mind. Enterprises having heterogeneous computing environments will need other tools to provide security.

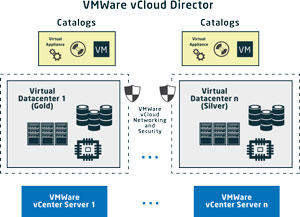

Cloud Computing

Cloud computing is an increasingly important way for enterprises to accomplish their IT goals. Since so much cloud infrastructure -- hosting workloads in the datacenter of a services provider, and the need for interoperability and agility -- is often based on virtualization, VMware's strong virtualization profile is seen as a good launching point for its entry into the market.

VMware has positioned its technology as a solution for all three cloud environments: public, private (on-premises) and hybrid. Its cloud platform, as one would expect, is based on its own tools. The company has packaged its virtualization technology and management tools in the form of vCloud Suite, vSphere, VSAN and EVO SDDC. It's also a component of Site Recovery Manager.

It has also established partnerships with hardware suppliers, as well as software and services providers, to deliver its virtualization technology to enterprises that have chosen cloud-computing frameworks like CloudStack and OpenStack.

Competitive Threats

The next item to consider is competitive threats to VMware. The company typically ignores competitive threats when speaking in public or in its marketing messages. Of course, that doesn't mean it ignores them in the market. More than ever, VMware is facing intense competitive pressure in all areas of virtualization, from a multitude of directions. Let's examine these areas of threat, starting with virtualization technology suppliers.

Citrix

Citrix is one of the few suppliers that has a portfolio that extends to offer products in all seven layers of the Kusnetzky Group model of virtualization technology. The company typically plays the "vendor neutral" and "do you want so many eggs in one vendor basket?" cards in its marketing messages. Its access virtualization technology often supports new mobile device technology on the day it's announced. While it was a founding member of the OpenStack Group, the company has focused a great deal of its attention on CloudStack.

Microsoft

Microsoft has developed or acquired technology in all seven layers of the Kusnetzky Group model. The company acquired Connectix, an early VMware competitor, and has reengineered that company's technology to produce Hyper-V. Microsoft is increasingly baking virtualization technology into its OSes, development tools, management tools, storage tools, databases and anything else it thinks about.

For the most part, virtualization is being used as a tool to bolster the interest in and adoption of Microsoft products, rather than truly being focused on merely solving enterprise-computing problems.

Open Source

Some of VMware's liveliest competition is coming from open source communities and suppliers that have based their offerings on open source projects. This includes competitors such as Red Hat Inc., SUSE, Canonical Ltd. and others.

The open source communities have addressed all seven layers of the Kusnetzky Group model. The technology coming out of these efforts often are well-tested and quite sound; but they do require some IT background and flexibility.

The suppliers in these communities typically ask, "Why pay the xtax on your business?" (where "x" is whatever commercial supplier they're competing with at the moment) when speaking about any commercial vendor. Red Hat, for example, is known to speak about the "Red Hat discount" that other vendors would offer when they learned that Red Hat was one of the competitors.

Thunder Clouds

VMware's cloud computing offerings are facing serious competition from a number of directions.

Amazon

Amazon Web Services Inc. (AWS) is the market leader and offers a worldwide presence. AWS has grabbed the leadership position and is driving forward with a complicated brew of proprietary technology and complex pricing. It's also driving down costs, using its economies of scale to undercut competitors like VMware.

Microsoft

With Microsoft Azure, Redmond is a relative latecomer to the cloud game, but is using the same tactics it has used for years to get into enterprise datacenters. That strategy is to build tools into all of its products that drive decision makers to believe that if they're using Windows, the best choice for any other technology is Microsoft. The company's cloud offerings came out of nowhere, and are now the second choice for suppliers.

Open Source

Open source communities are supporting a number of cloud platforms and a number of variations on each cloud platform. As with open source virtualization technology, the technology coming out of these efforts often are solid and stable, but also need significant expertise -- which many companies simply don't have -- to implement and manage.

As with virtualization technology, the suppliers in these communities raise the specter of a heavy "tax" that's paid in order to use a commercial competitor's products. They also point out that their tools are modular, modifiable and can be tuned to the precise needs of the enterprise.

Microsoft Style

VMware has been pulling pages out of the Microsoft playbook for quite some time. It started with VM software, and has been extending out to all the other areas of virtualization. As the industry extended the use of virtualization technology into cloud computing environments, VMware followed the market and started offering its technology packaged for use by enterprises for their private cloud computing environments, and by cloud services suppliers for their public and private cloud offerings.

VMware has settled on EVO SDDC to be its enterprise workload delivery technology, and it's made solid inroads into that market. Typically it uses a Microsoft-like "embrace, extend and control" set of tactics.

Once a company selects a VMware product, they find that it's simply easier, and less of an integration headache, to select another of the company's products in adjacent markets.

The Dell Question

A key question is whether VMware will continue to use this approach once Dell completes the acquisition of EMC. Much of the market is demanding open, interoperable, extendable, reliable and cost-effective software. This often extends to demanding simple terms and conditions and easily understandable, believable licensing. Companies expect not only a low entry cost, but also low incremental costs as new features and functions are added to the portfolio.

What is clear is that Dell's acquisition of EMC muddies the waters quite a bit. It's not yet known how Dell is going to integrate enterprise storage and virtualization/cloud computing infrastructure into its portfolio, and whether it will continue to allow others to integrate VMware products into its offerings.

Balancing Act

VMware faces the serious challenge of balancing a huge share of the market and a diminishing level of growth. It's very hard for the market leader to grow faster than the market as a whole when it represents the lion's share of the market. Stakeholders often demand increasing share and increasing revenues. Market leaders often deal with these demands by finding ways to increase revenue from the existing customer base. This means finding a way to raise prices.

It's clear that this wouldn't be a good move in today's hyper-competitive market. Increasing prices in the face of extensive competition coming from other suppliers would cause many cost-conscious organizations to consider jumping ship to adopt products and services offered by others.

Building a walled garden in customer datacenters, while an attractive thing for product planners, flies in the face of customer demands for openness, interoperability, security and management. To paraphrase Princess Leia Organa: "The more you tighten your grip, the more current and potential customers will slip through your fingers."

The Choice: Open or Closed?

My advice for VMware: Make it easy for your customers to manage and secure multi-vendor environments that include some of your tools and technology. You know that they're going to do it anyway, and if you make it difficult enough, you might find yourself written out of their future plans.

We'll just have to see what VMware's executive team is going to do, and whether the company will embrace an open approach or strengthen the walls in their walled garden.