News

Rubrik, Veeam Lead in Changing Backup & Data Protection Market

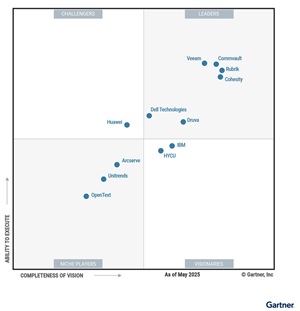

In research firm Gartner's latest Magic Quadrant report on the enterprise backup and data protection market, the company Rubrik leads the axis for completeness of vision, while Veeam is tops for the ability to execute, both by tiny margins. They are closely grouped with Commvault and Cohesity, with Dell Technologies and Druva filling out the topmost quadrant.

However, the most striking thing about the new report is a remarkable transformation of the space covered by Gartner, which this year renamed the report to replace "backup and recovery" with "backup and data protection." This marks a fundamental shift toward platform-centric, AI-augmented, cyber-resilient architectures that go well beyond traditional recovery. Backup is no longer just about restoring files after an outage -- it's now about orchestrating cross-cloud recovery, detecting ransomware in real time, protecting SaaS and IaaS workloads, and leveraging GenAI to automate operations.

Gartner's rebranding of the report as the Magic Quadrant for Backup and Data Protection Platforms reflects this expanded mandate, emphasizing that modern solutions must unify data protection across hybrid, multicloud, and SaaS environments while also enabling broader data utility for compliance, analytics, and security use cases.

"The backup and data protection platforms (BDPP) market is an evolution of the former enterprise backup and recovery software solutions market. This evolution reflects the new and changing requirements of enterprise organizations as they address the demands of protecting their sprawling and complex data estate," says the Gartner report, published last month.

Perhaps surprisingly, while cloud infrastructure is paramount in the report, the "Big 3" cloud giants don't figure at all here. Microsoft was the lone hyperscaler in the last couple of reports, described as a niche player, but not this year.

Further speaking to the transformation of the market, Gartner listed the following strategic planning assumptions for the report:

- By 2029, 75% of enterprises will use a common solution for backup and recovery of data residing on-premises and in cloud infrastructure, compared with 25% in 2025.

- By 2029, 80% of enterprises will prioritize backup of SaaS applications as a critical requirement, compared with 20% in 2025.

- By 2029, 95% of backup and data protection platforms products will include embedded technology to detect and identify cyberthreats, compared with 55% in 2025.

- By 2029, 85% of large enterprises will adopt backup as a service (BaaS), alongside customer-managed deployments, to back up cloud and on-premises workloads, compared with 25% in 2025.

- By 2029, 90% of backup and data protection platforms products will integrate generative AI (GenAI) to improve management and support operations, compared with fewer than 25% in 2025.

- By 2029, 35% of enterprises will implement agentic AI capabilities to perform autonomous backup operations, up from less than 2% in 2025.

- By 2029, 30% of enterprises will integrate backup copies as a data source for analytics and inference, up from less than 5% in 2025.

Besides the "Leaders" noted above, "Visionaries" include IBM and HYCU, while other vendors in the "Niche Players" quadrant include Arcserve, Unitrends, and OpenText. Huawei was the sole "Challenger."

As the quadrants from the past few years show, not much has changed among the major players, with Veeam, Commvault, Rubrik, Cohesity and Dell consistently among the leaders.

[Click on image for larger view.] 2025 Magic Quadrant for Backup and Data Protection Platforms (source: Gartner).

[Click on image for larger view.] 2025 Magic Quadrant for Backup and Data Protection Platforms (source: Gartner).

[Click on image for larger view.] 2024 Magic Quadrant for Enterprise Backup and Recovery Software Solutions (source: Gartner).

[Click on image for larger view.] 2024 Magic Quadrant for Enterprise Backup and Recovery Software Solutions (source: Gartner).

[Click on image for larger view.] 2023 Magic Quadrant for Enterprise Backup and Recovery Software Solutions (source: Gartner).

[Click on image for larger view.] 2023 Magic Quadrant for Enterprise Backup and Recovery Software Solutions (source: Gartner).

The Leaders

Here's a summary of what Gartner had to say about the leaders:

- Rubrik -- Recognized for its comprehensive cyberrecovery and detection capabilities, including AI-driven in-line anomaly detection, malware scanning, and prioritized identity recovery. Rubrik also introduced Annapurna, a retrieval-augmented generation (RAG) platform for GenAI application development using backup data.

- Veeam -- Noted for its strong ransomware defense, with AI-based threat scanning, immutable storage, and cross-platform restore features. Veeam's Data Platform supports hybrid and multicloud environments and now includes proactive tools like Threat Hunter and IOC detection.

- Commvault -- Commended for its cloud infrastructure coverage and cyberresilience tools, such as Cloud Rewind and Cleanroom Recovery. Strategic acquisitions of Appranix and Clumio enhanced its cloud-native application recovery capabilities and AWS integrations.

- Cohesity -- Strengthened by its acquisition of Veritas' NetBackup and Alta portfolios, expanding its reach across large enterprise deployments. Gartner praised its recovery orchestration, GenAI tools, and security services through the Cyber Event Response Team (CERT).

- Dell Technologies -- Offers deep integration with Dell storage infrastructure and managed detection services via CrowdStrike. However, Dell is cited for lagging SaaS control plane maturity and limited cloud-native application coverage.

- Druva -- Delivered fully cloud-native capabilities on AWS, with managed cyberresilience services, native SaaS application support, and strong AI tooling (Dru Investigate, Dru Assist). Gartner highlights Druva's operational simplicity and rapid innovation.

Visionaries and Other Notables

- IBM -- Continues to invest in AI-driven protection with watsonx, supporting real-time anomaly detection and application-aware insights. Challenges remain in its reliance on third-party tools and limited multicloud support.

- HYCU -- A visionary for its low-code SaaS protection framework (R-Cloud) and broad coverage of GCP workloads. However, it lags in ransomware response breadth and integration of native anomaly detection.

- Huawei -- The sole "Challenger," with flash-optimized appliances and multilayer ransomware defenses. However, its platform remains heavily Huawei Cloud-dependent, limiting broader multicloud viability.

- Niche Players -- Arcserve, OpenText, and Unitrends are characterized by more focused portfolios, with strengths in specific deployment models or markets, but lacking the full breadth or innovation of Leaders.

AI, Cyberdefense, and SaaS Protection Take Center Stage

Beyond the vendor rankings, the 2025 report underscores a broader transformation: the convergence of backup with AI-driven automation, cyberresilience, and SaaS workload coverage.

- GenAI in Backup: Gartner highlights growing adoption of generative AI for simplifying administration, threat detection, and recovery workflows. Druva's Dru Assist is cited as an example, offering guided troubleshooting and security insights. While not mentioned in the report, other vendors have also introduced named AI assistants to enhance platform usability. Gartner projects 90% of backup platforms will feature GenAI by 2029, up from under 25% in 2025.

- Ransomware Recovery: Vendors are embedding curated snapshot selection, real-time entropy detection, and malware scanning to identify the cleanest recovery points. Immutable vaults and isolated recovery environments are now table stakes.

- SaaS Protection: Support for Microsoft 365 and Salesforce is widespread, but vendors are quickly expanding into services like Microsoft Entra ID, ServiceNow, Jira, Slack, and Workday. HYCU and Druva lead in scope; Veeam and Dell trail slightly in breadth.

Rise of SaaS-Based Control Planes

Gartner also highlights the shift from customer-managed consoles to vendor-hosted control planes that span on-prem, cloud, and edge environments. These unified management layers enable centralized orchestration, improved visibility, and better automation of backup and recovery.

Rubrik, Druva, and HYCU are at the forefront with cloud-native architectures. Dell and OpenText, meanwhile, are flagged for fragmented interfaces and slow SaaS transition.

What Sets Leaders Apart

According to Gartner, maintaining a leadership position requires more than solid execution. Top performers must:

- Extend GenAI beyond assistants to full lifecycle orchestration and diagnostics

- Protect a broad and growing roster of SaaS apps and cloud-native services

- Support autonomous, policy-driven recovery with agentic AI

- Adopt flexible, usage-based licensing for hybrid and multicloud environments

As Gartner notes, some vendors like Cohesity and Rubrik are aggressively pushing boundaries, while others like Dell and IBM face pressure to modernize their architectures and unify user experience. The Cohesity-Veritas merger, completed in December 2024, remains a wildcard that could either bolster or fragment their combined product strategy.

Final Takeaway

The 2025 Magic Quadrant makes one thing clear: backup is no longer just about data recovery -- it's about resilience, security, and operational intelligence. For enterprise IT teams navigating hybrid and multicloud environments, the right platform offers not just insurance, but active defense and automation in the face of growing cyberthreats and complexity.

As Gartner puts it: “Solutions must offer effective capabilities to simplify the management of data protection across increasingly complex and diverse environments. This includes capabilities to test, expedite and orchestrate data recovery responses for both traditional disaster and cyberevents.”

Available for Free

While Gartner typically provides research to only paid clients, its Magic Quadrant series of reports are commonly available in complimentary licensed-for-distribution editions from participating vendors, easily found with a quick web search.