News

ChatGPT's Dominance Gets Google Cloud Tech Boost

A new report analyzing recent global usage of generative AI tools confirms that OpenAI's ChatGPT remains the clear leader, with that lead possibly growing thanks to a pact for the company to use Google cloud tech.

That information comes in this month's "Top AI Tools by Web and App Usage (July 2025 Data)" blog post, published by Similarweb, a digital intelligence platform. The report tracks web traffic, monthly active users (MAUs), daily stickiness (the percentage of users who return daily), and mobile app downloads across dozens of AI tools.

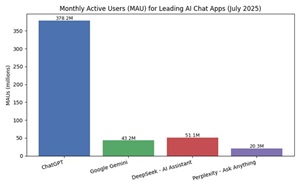

The report shows ChatGPT commanding nearly 80% of web traffic among tracked platforms. With 5.72 billion website visits, 378.2 million monthly active users, and a 43.75% daily stickiness rate, ChatGPT's engagement metrics far exceed those of its closest competitors.

[Click on image for larger view.] Monthly Active Users (MAU) for Leading AI Chat Apps (July 2025) (source: Similarweb).

[Click on image for larger view.] Monthly Active Users (MAU) for Leading AI Chat Apps (July 2025) (source: Similarweb).

This lead is poised to grow further following OpenAI's confirmed expansion to Google Cloud infrastructure, as reported by CNBC and many others after Google Cloud Platform (GCP) was added to OpenAI's sub-processor list, a list that also includes, Microsoft, Oracle, and other cloud heavyweights.

The move adds GPU capacity and geographic reach across five new regions, including Japan and the Netherlands, and complements existing deployments on Microsoft Azure, Oracle Cloud, and CoreWeave, specifically concerning API, ChatGPT Enterprise, ChatGPT Edu, and ChatGPT Team.

Enterprise Implications: Multi-Cloud AI Is Now a Reality

For IT professionals and cloud architects, OpenAI's infrastructure diversification signals a shift toward multi-cloud AI deployment models. This has direct implications for:

- Latency Optimization: Regional deployments across Google Cloud regions may reduce latency for enterprise users integrating ChatGPT into customer-facing applications or internal automation workflows.

- GPU Access and Cost Management: Diversifying across cloud providers allows OpenAI to tap into competitive GPU pricing and availability, which could stabilize API performance and pricing for enterprise customers.

- Resilience and Redundancy: Multi-cloud architecture reduces single-provider risk, a key consideration for regulated industries and mission-critical workloads.

As ChatGPT becomes more deeply embedded in enterprise workflows--from virtual agents to developer copilots--IT teams should anticipate tighter integration with OpenAI's APIs and model endpoints across multiple cloud platforms. This may affect decisions around VPC peering, IAM policies, and observability tooling.

Challengers Show Momentum in Specific Metrics

While ChatGPT continues to lead across most usage metrics, several challengers are showing meaningful traction in specific areas that may warrant attention from enterprise IT teams. Google Gemini, for example, led all platforms in mobile app downloads for July, logging 102.42 million installs--well ahead of ChatGPT's 62.86 million. This suggests strong distribution momentum, particularly in Android-first environments and Google-aligned enterprise ecosystems.

However, that was the only category where ChatGPT wasn't No. 1, and Gemini's engagement metrics tell a different story. Its daily stickiness rate--defined as the percentage of users who return daily--was just 5.45%, compared to ChatGPT's 43.75%. Monthly active users (MAUs) also lagged, with Gemini reporting 43.18 million versus ChatGPT's 378.2 million. For IT leaders, this gap between reach and retention may signal that Gemini is still in the early stages of enterprise integration or user habituation.

Other tools are gaining ground through different strengths. DeepSeek posted 51.13 million MAUs, outperforming Gemini in that category, and showed moderate stickiness at 19.45%. Perplexity, while smaller in scale, had a notably high stickiness rate of 22.01%, indicating strong repeat usage among its 20.27 million monthly users. These metrics suggest that Perplexity may be carving out a niche in research-heavy or developer-centric workflows where sustained engagement matters more than raw traffic.

| AI Tool |

Website Visits |

MAUs (App) |

Downloads |

Rating |

Daily Stickiness |

| ChatGPT |

5.72B |

378.2M |

62.86M |

4.67★ |

43.75% |

| Google Gemini |

699.6M |

43.18M |

102.42M |

4.60★ |

5.45% |

| DeepSeek |

350.4M |

51.13M |

2.76M |

4.28★ |

19.45% |

| Perplexity |

140.6M |

20.27M |

7.07M |

4.61★ |

22.01% |

Source: Similarweb

For cloud and virtualization teams, these patterns offer practical guidance. Gemini's download lead may reflect bundling strategies or mobile-first distribution, but lower engagement suggests that enterprise adoption is still maturing. DeepSeek and Perplexity, meanwhile, may offer differentiated value in specific verticals or regional markets. IT leaders evaluating generative AI platforms should weigh not just adoption metrics, but also usage depth, integration maturity, and alignment with existing cloud infrastructure.

Top AI Tools in the U.S. by Web and App Engagement

The U.S. continues to be the largest national market for ChatGPT and several other AI platforms. Based on Similarweb's July 2025 data, 15.10% of ChatGPT's website traffic originates from U.S. users--more than any other country. That share is also trending upward, with an 8.9% increase month-over-month. Adoption patterns suggest that American users are integrating generative AI into a wide range of operational and creative workflows, with the company specifically listing:

- Customer Support: Businesses deploy ChatGPT and Gemini in live-chat interfaces to handle routine inquiries before escalating to human agents.

- Marketing & Copywriting: Agencies and startups use GPT-4-based tools to draft promotional emails, product blurbs, and social media content.

- Code Generation: Developers working in environments like Replit rely on AI assistants to generate boilerplate code and assist with debugging.

Regional Dynamics and Strategic Considerations

The report highlights strong growth in emerging markets such as India, Brazil, and Southeast Asia, where mobile-first adoption is driving traffic. In contrast, China's AI usage remains dominated by domestic platforms like Quark and Doubao due to regulatory constraints.

For enterprise teams deploying AI globally, this underscores the need to:

- Localize AI Interfaces: Language models must be tuned for regional dialects, compliance requirements, and cultural context.

- Monitor Regulatory Shifts: Data residency and AI governance frameworks vary widely, especially in APAC and LATAM markets.

- Optimize for Mobile Engagement: High download volumes in mobile-first regions suggest that mobile UX and SDK integration will be critical for adoption.

Actionable Guidance for Cloud and Dev Teams

"Businesses should tailor AI adoption strategies to regional conditions, focusing on localization, regulatory compliance, and user engagement," said author Limor Barenholtz, director of SEO at Similarweb. Enterprise IT leaders should treat ChatGPT as a strategic anchor for AI workloads, but not the only one. The rise of Gemini, DeepSeek, and Perplexity--each with distinct strengths--suggests that platform evaluation should consider:

- Engagement vs. Reach: High download numbers may reflect marketing success, but daily stickiness is a better proxy for sustained value.

- API Ecosystem Maturity: ChatGPT's ecosystem includes robust developer tooling, plugin frameworks, and enterprise support channels.

- Infrastructure Alignment: Multi-cloud deployments may require rethinking network architecture, observability, and cost modeling.

As generative AI becomes embedded in everything from customer support to code generation, IT teams must align platform choices with infrastructure strategy, developer experience, and long-term scalability.

Barenholtz explained the methodology: "For this analysis, I used Similarweb's July 2025 data to compare the global and regional performance of the most influential AI tools by analyzing both website visits and mobile app usage, as well as user engagement and traffic quality. I also looked at recent product updates and search trends to provide context."

About the Author

David Ramel is an editor and writer at Converge 360.