News

Two Same-Day Cloud Spending Reports, Same Conclusions

Two new same-day reports on Q1 2022 cloud infrastructure services spending basically say the same thing: growth is everywhere, AWS is still in the lead, Azure and GCP are making inroads and so on -- similar to just about every other report over the past several years.

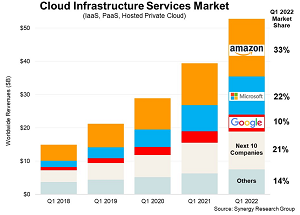

"As the vibrant cloud market continues to grow rapidly, Amazon continues to lead with its worldwide market share remaining at 33 percent. For the third consecutive quarter its annual growth came in above the growth of the overall market. Meanwhile Microsoft continues to gain almost two percentage points of market share per year while Google's annual market share gain is approaching one percentage point. In aggregate all other cloud providers have grown their revenues by over 150 percent since the first quarter of 2018, though their collective market share has plunged from 48 percent to 36 percent as their growth rates remain far below the market leaders," said Synergy Research Group in its report.

[Click on image for larger view.] Synergy Research Group Report (source: Synergy Research Group).

[Click on image for larger view.] Synergy Research Group Report (source: Synergy Research Group).

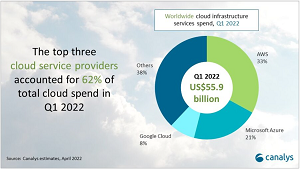

"Amazon Web Services (AWS) was the leading cloud service provider in Q1 2022, accounting for 33 percent of total spend after growing 37 percent on an annual basis," Canalys said in its report, along with "Microsoft Azure was the second largest cloud service provider in Q1, growing by 46 percent to take a 21 percent market share" and "Google Cloud was the fastest growing of the top three, increasing by 54 percent in the latest quarter to account for 8 percent of the market."

[Click on image for larger view.] Canalys Report (source: Canalys).

[Click on image for larger view.] Canalys Report (source: Canalys).

Overall spending numbers were also similar.

Synergy: "New data from Synergy Research Group shows that Q1 enterprise spending on cloud infrastructure services was approaching $53 billion. That is up 34 percent from the first quarter of 2021, making it the eleventh time in twelve quarters that the year-on-year growth rate has been in the 34-40 percent range."

Canalys: "Worldwide cloud infrastructure services spending increased 34 percent to $55.9 billion in Q1 2022, as organizations prioritized digitalization strategies to meet market challenges. The latest Canalys data estimates expenditure was over $2 billion more than in the previous quarter and $14 billion more than in Q1 2021. The top three cloud service providers have benefited from increased adoption and scale, collectively growing 42 percent year on year and accounting for 62 percent of global customer spend."

Here are summaries from execs at both companies:

Synergy: "While the level of competition remains high, the huge and rapidly growing cloud market continues to coalesce around Amazon, Microsoft and Google," said John Dinsdale, a chief analyst at Synergy Research Group. "Aside from the Chinese market, which remains totally dominated by local Chinese companies, other cloud providers simply cannot match the scale and geographic reach of the big three market leaders. As Amazon, Microsoft and Google continue to grow at 35-50 percent per year, other non-Chinese cloud providers are typically growing in the 10-20 percent range. That can still be an attractive proposition for those smaller providers, as long as they focus on regional or service niches where they can differentiate themselves from the big three."

Canalys: "Cloud has continued to be a hot market and transformation strategies are emphasizing digital resiliency to face the market challenges of today and tomorrow," said Canalys research analyst Blake Murray. "To be effective in resiliency planning, customers are turning to channel partners with the technical and consulting skills to help them effectively embrace hyperscaler cloud services." And: "As the use cases for cloud infrastructure services expand so does the potential complexity, and we see that hybrid and multi-cloud deployments are commonplace in the market," said Canalys research analyst Yi Zhang. "The hyperscalers are investing in rapid channel development and partners are responding as the opportunities grow."

Stay tuned for Q2 repeat reports in about three months.

About the Author

David Ramel is an editor and writer at Converge 360.