News

Quantum Computing Report: 'Naysayers Now a Minority'

Quantum computing, long a futuristic pie-in-the-sky concept that doesn't seem to advance much in real-world use cases, is finally gaining some traction, a new report indicates.

"Early enterprise adopters of quantum computing are moving past the exploration stage, building the applications and teams they will need to leverage quantum technology and gain a competitive advantage," says a new survey-based report from Zapata Computing, a specialist in the emerging field.

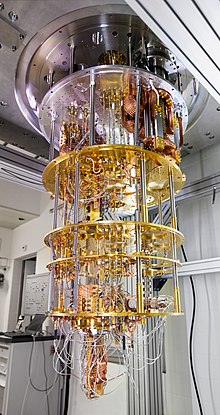

Quantum Computer Based on Superconducting Qubits Developed by IBM Research (source: Wikipedia).

Quantum Computer Based on Superconducting Qubits Developed by IBM Research (source: Wikipedia).

Part of the problem with that extended "exploration stage" is the difficulty in understanding and explaining what quantum computing is all about. Indeed, one of the highlights of "The First Annual Report on Enterprise Quantum Computing Adoption" is "Quantum Computing Still Ain't Easy to Explain," wherein it's noted that "96 percent of respondents would need more than 10 minutes to explain quantum computing to a friend at a party." This reporter would need more than that, so here's how Wikipedia begins to explain it: "Quantum computing is a type of computation that harnesses the collective properties of quantum states, such as superposition, interference, and entanglement, to perform calculations." So, however this powerful new computing paradigm works, it's starting to take hold in the enterprise, according to the December 2021 survey of 300 leaders at large global enterprises (CIOs, CTOs and other VP-level and above executives) with estimated 2021 revenues of over $250 million, and estimated computing budgets over $1 million.

Following those early adopters, Zapata said, "close behind, other enterprises acknowledge they must address quantum's promise to disrupt -- and are beginning to take concrete steps to investigate exactly where it can impact their businesses. All organizations believe it is still too early to tell which technology platforms will be the ultimate winners, and are concerned about being locked in with the wrong partners."

Claiming that quantum computing has moved from the enterprise fringes to the core of analytics agendas, Zapata offered these supporting data points:

-

The quantum naysayers are now a minority. 74 percent of enterprise leaders agree that “those who fail to adopt quantum computing solutions will fall behind.”

-

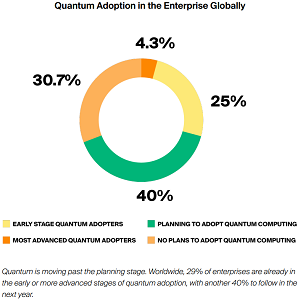

Quantum is now moving beyond the planning stage. 69 percent of enterprises across the globe reveal they have adopted or are planning to adopt quantum computing in the next year. Those who have already adopted in some form are close to one-third of the market at 29 percent.

[Click on image for larger view.] Quantum Adoption in the Enterprise Globally

(source: Zapata Computing).

[Click on image for larger view.] Quantum Adoption in the Enterprise Globally

(source: Zapata Computing).

However, the firm also noted that while U.S. respondents led in quantum adoption -- followed closely by Canada and China -- the global data may not line up with other reports because of the small sample sizes from several countries.

Other highlights of the report as presented by Zapata include:

-

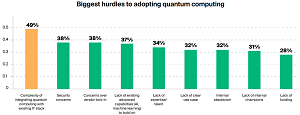

Complexity Is the Greatest Barrier to Quantum Adoption

[Click on image for larger view.] Still Too Complex

(source: Zapata Computing).

[Click on image for larger view.] Still Too Complex

(source: Zapata Computing).

- The biggest hurdle to quantum adoption is the complexity of integrating quantum computing with the existing enterprise IT stack, a hurdle shared by 49 percent of respondents.

- The complexity of quantum computing is undeniable, and enterprise IT architectures were already complex. Yet, early and more advanced quantum adopters are working through these complexities, mostly with the help of outside vendors. Managing this complexity calls for new workflows to orchestrate the intersection of new quantum and existing classical components.

-

Early Quantum Adopters Set the Stage for Their Peers Across the Globe

- Enterprises leading in quantum adoption are setting the example for the rest of the market -- they are already on the way to an advantage, with 12 percent of early and advanced quantum adopters expecting to achieve some form of competitive advantage within the next year; and 41 percent expecting some form of competitive advantage within two years. The long-held belief that quantum is years -- if not decades -- away, is no more.

- American companies report being the closest to a quantum competitive advantage, with 12 percent of enterprises that have started on the path to quantum adoption expecting to achieve an advantage within one year, if they haven't already.

- Germany is the most bullish on achieving competitive advantage with quantum within two years, with 44 percent of German respondents predicting an advantage within two years, followed by Canada at 38 percent, the U.K. and Australia at 33 percent each, and the U.S. at 31 percent.

- The driving motivator behind quantum's adoption is that quantum is poised to deliver better business performance and results, according to 60 percent of those who are already investing in quantum or are planning to in the next year.

-

Lessons Learned From Those Furthest Along in Quantum Adoption

- The most advanced quantum adopters are 70 percent more likely than all enterprise leaders to invest in quantum for workforce development.

- The most advanced quantum adopters and those who are investing more than $1 million are more motivated by their first-mover advantage compared to the rest. Those already investing over $1M in quantum are also 50 percent more likely to do it to block intellectual property (IP) than anyone else. Given the mosaic of early technology adopters among the global sample (44 percent vs. those adopting with the majority or later at 56 percent), quantum is indeed becoming the new competitive weapon within the enterprise tech arsenal.

-

Machine Learning Paves the Quantum Way in the Near Term, Especially in the U.S.

-

Machine learning (ML) and data analytics problems are the top use cases for early and more advanced adopters of quantum computing, particularly in the U.S., where 71 percent of enterprises are investing in ML and data analytics problems compared to 51 percent worldwide. This is intuitive because enterprises already have ML talent, algorithms and applications in place. Machine learning is also the most likely use case to deliver near-term value for businesses because areas where classical ML struggles -- such as generative models in unsupervised and semi-supervised learning for augmenting datasets in predictive models -- are better suited for quantum devices.

-

Quantum Investments Are Getting Serious

- 28 percent of global enterprises on the path to quantum adoption are investing more than $1 million in quantum computing. This is a turning point from the ~$100K R&D budgets of the past.

- The early adopters of technology more broadly are investing the most in quantum computing. 37 percent of early tech adopters have quantum budgets over $1M, vs. 13 percent for late tech adopters.

-

Quantum Is a Trusted Team Sport

- A whopping 96 percent agree that their organization could not successfully adopt quantum computing without the help of a trusted technology partner.

- When choosing an outside partner, enterprises look first and foremost at forward compatibility of the partner's solutions at 48 percent, followed by ease of use of solutions at 42 percent, and ease of solution integration at 41 percent.

- Published research was rated as fourth at 38 percent, indicating that quantum is moving beyond the academic realm and into practical enterprise reality.

-

What Are the Most Advanced Quantum Adopters Doing to Prepare?

- Quantum-adopting enterprises are preparing on multiple fronts: 51 percent are identifying talent/building an internal team; 49 percent are experimenting and building proofs of concept; 48 percent are running experiments on quantum hardware or simulators, and 46 percent are building new applications.

-

Vendor Love and Vendor Jitters: Vendor Lock-in Is the Biggest Concern

- Enterprises want to have their cake and eat it too: while almost all (96 percent) say they need help from a trusted vendor to succeed in their quantum initiatives, 73 percent are concerned about vendor lock-in. Another 39 percent cited vendor lock-in concerns as a hurdle to adoption.

- The most advanced quantum adopters are also much more likely to be concerned about vendor lock-in, with 92 percent concerned compared to the 73 percent concerned among all quantum adopting organizations. These organizations don't want to lose flexibility -- since quantum is not general�purpose (much like bare metal vs. branded servers vs. HPC), they don't want to be locked into a proprietary methodology or solution.

"The current survey shows that the early adopters of quantum computing technologies expect to achieve a competitive advantage over their peers very soon," Zapata said in conclusion. "A majority of global enterprises are now planning to adopt quantum computing or have already started, and once the early leaders achieve an advantage, there will be a profound urgency for others to accelerate their quantum adoption strategies.

"Still, the survey also revealed a number of key barriers for enterprises to overcome on their path to a quantum competitive advantage. The complexity of the technology remains the greatest hurdle to overcome, so early adopters are partnering with outside vendors to manage it. However, vendor lock-in will be an ongoing concern, and enterprises will want flexibility and forward compatibility with any vendor they work with."

About the Author

David Ramel is an editor and writer at Converge 360.