News

Data Scientists vs. AI Pros: Who Makes the Most Money?

Executive recruiting firm Burtch Works, noticing an unprecedented increase in tech salaries since the post-pandemic economic recovery started, published a new report that sheds light on just how much money data scientists and AI pros make now -- and who makes the most.

It clearly pays to be in either camp, though, as top-level managers in both categories can see salaries around $300,000.

"Our data shows that 2022 salaries significantly increased at all job levels for both data scientists and AI professionals," the company said in announcing the new 2022 Data Science & AI Professional Salary Report. "These salary increases are unlike anything we have seen in the past (it's our 10th year delivering this report), and these unprecedented times in the job market are still continuing to make a strong impact on candidate compensation."

In distinguishing between the two jobs, the company said AI pros typically work with very large sets of unstructured data, which requires additional computer science skills, while traditional -- or "other" data scientists -- usually work with more structured (tabular) data. AI pros are also said to be proficient in tech like relational databases and the major cloud computing platforms, Amazon Web Services (AWS), Google Cloud Platform (GCP) and Microsoft Azure.

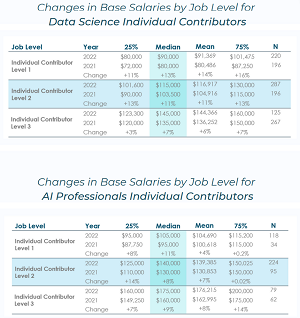

That extra skilling for AI pros shows up in a salary comparison, wherein Burtch Works measured three different levels of experience for both individual contributors (ICs) and management personnel. Generally speaking, AI pros make slightly more than other data scientists.

Among individual contributors, for example, both median and mean salaries tend to be higher for AI pros, although the percentage increase in salaries from 2021 to 2022 varies among different levels. In comparing median salaries, AI pro mid-level individual contributors, for example, made more than data scientists ($140,000 vs $115,000), but the latter enjoyed an 11 percent increase from 2021, while AI pros' median salaries increased by a smaller amount, 8 percent. That's illustrated in this comparison:

[Click on image for larger view.] Changes in Base Salaries by Job Level for Individual Contributors (source: Burtch Works).

[Click on image for larger view.] Changes in Base Salaries by Job Level for Individual Contributors (source: Burtch Works).

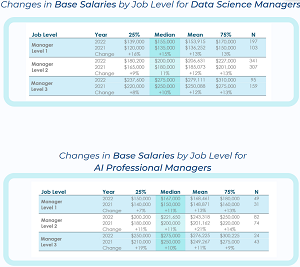

For management, the situation is similar. Top-level AI pro managers and data science managers, for example, both earned a median salary of $275,000 in 2022, up 10 percent from 2021. At the other end of the management spectrum (level 1), the median 2022 salary for AI pro managers was $167,000, up 11 percent from 2021. Data science level 1 managers, by contrast, earned a smaller median salary ($155,000), but those salaries grew more, by 15 percent vs. 11 percent. This graphic tells the story:

[Click on image for larger view.] Changes in Base Salaries by Job Level for Managers (source: Burtch Works).

[Click on image for larger view.] Changes in Base Salaries by Job Level for Managers (source: Burtch Works).

"At the IC level, many times AI professionals will have a PhD and command a higher salary, however once these individuals move into management roles the difference between data science and AI salaries shrink as management skills become the focus," the report said.

The report also breaks down salaries by region, education and other factors.

Burtch Works also noted some generalizations, including:

- The Education Sramble: The company noted a small decrease in the number of professionals with PhDs among both the AI professionals and data science samples, slightly reversing the trend from 2021 data where increases were seen. For example, the AI pros sample decreased from 48 percent in 2021 to 39 percent in 2022, while the data science sample decreased from 19 percent in 2021 to 12 percent in 2022. "As business applications for data science and analytics have become more complex, and as the discipline has matured, it has created a friendlier environment for people with Master's degrees to complete data related endeavors that were done by PhDs only a handful of years ago," the report said.

- The Great Resignation: With the COVID-19 pandemic, many workers put their job searches on hold, but the beginning of the 2021 economic recovery saw those job searches resume, while more data teams planned to hire new workers. "Unfortunately for those looking to hire, this has led to fewer professionals on the market in 2022, and a lower inventory of available candidates," the company said. "Many candidates that are still on the market are coming to the table with numerous offers and are seeking a meaningful increase in salary, along with other benefits."

- Interview Process Has Become Streamlined: "From our recent conversations with clients and candidates, it is evident that the interview process has seen some immense shifts over the past few years and companies have realized the importance of improving their interviewing strategies to allow for a streamlined and effective process when vetting candidates for their open roles," the report said. "It is also notable that long-form technical assessments and coding exams are used less frequently in the interview process and companies are beginning to assess a gap in skill as something that could be closed through training and mentorship when a candidate is onboarded."

- Women's Industry Representation: "In our Data Science sample, the percentage of women fell from 25 percent last year to 24 percent in 2022," said Burtch Works. "In our AI Professionals sample, while the percentage of women did increase from 17 percent in 2021 to 20 percent in 2022, it is still notable and continues to point to disparities in industry representation as women are still heavily underrepresented in the space."

- Common Industries Diversifying: "Over the past few years, the economic disruption and digital transformation in financial services has led to more institutions investing in data science and AI hires, which were uncharacteristically high in 2022 compared to past years. The concentration in the financial services space, along with the push to be enabled by technology investments to the cloud are all factors towards industry-wide adaptations," the company said.

- WFH vs Hybrid Model? "With many companies evaluating their WFH and remote work policies going forward, we sent out a survey earlier this year to gauge candidate and client WFH preferences," the company said. "The idea that remote work has opened doors for individuals to work in cities across the country is shifting quickly towards more and more requests to relocate. This evolution in policies is generally translating to a hybrid model where individuals are expected to come into the office on a partial or an as-needed basis. With that said, there are countless roles and opportunities open to those that are seeking a fully remote position, but they are not the majority of roles available as often assumed or reported by the media."

- Retention and Attraction Strategies are Brought to the Forefront: Burtch Works advised organizations to be aware of current market rates in order to retain key staff, as the company found that data professionals who changed jobs were receiving significant salary increases. What's more, some data teams use pre-emptive retention bonuses or spot bonuses to recognize key project work and retain staff, even raising salaries outside of the normal annual schedule. "Positive relationships can go a long way towards retaining employees, including managing relationships between you and your data team, as well as fostering camaraderie within the team," the report said. "Strong communication, transparency, and offering mentorship can all build stronger relationships between leadership and the team. For early career employees especially, focusing on team-building or fun activities can build stronger cohesion within the team, which can help make employees less likely to be tempted by other job offers."

-

Changes to Come: Storm Clouds on the Horizon? Recently the company has heard of companies implementing hiring freezes and layoffs, even among data science and AI professionals. That observation was made as the economy began a significant downturn in terms of inflation, stock market performance and other factors. "These uncertain times are causing a ripple in many industries: funds are slowing for smaller, newer companies and interest rate increases are impacting financial services firms," Burtch Works said. "Similarly, inflation is hurting CPG, retail and manufacturing firms, while supply chain issues are taking a toll on technology firms."

For the study, Burtch Works interviewed 1,841 data professionals (1,265 data scientists and 576 AI professionals) from the approximately 60,000 quantitative professionals with whom the company maintains contact. 2022 salary data was gathered from May 2021 through April 2022. Changes in compensation were measured by comparing medians (and other percentiles) of current compensation to those reported in last year's study.

About the Author

David Ramel is an editor and writer at Converge 360.